Western Grain Stabilization Regulations

C.R.C., c. 1607

Regulations Respecting the Stabilization of Net Proceeds from the Production and Sale of Western Grain under the Western Grain Stabilization Act

Short Title

1 These Regulations may be cited as the Western Grain Stabilization Regulations.

- SOR/82-570, s. 2(F)

Interpretation

2 In these Regulations,

- Act

Act means the Western Grain Stabilization Act; (Loi)

- feed

feed has the same meaning as it has in the Feeds Act; (aliments du bétail)

- feed mill operator

feed mill operator means a person who purchases grain from producers and processes the grain into feed, for sale; (exploitant d’usine d’aliments du bétail)

- producer’s number

producer’s number means the number assigned to a producer by the Canadian Wheat Board; (numéro du producteur)

- seed

seed has the same meaning as it has in the Seeds Act; (semences)

- seed company operator

seed company operator means a person who purchases grain from producers for cleaning and processing into seed, for sale. (grainetier)

- SOR/82-570, s. 3(F)

Payment of Levies Deducted

3 All amounts in respect of the levy required to be deducted pursuant to section 13 of the Act and all amounts in respect of the levy otherwise deducted by the licensee shall be paid pursuant to section 14 of the Act on or before the last day of the month immediately following the month in which the amounts were deducted by the licensee by forwarding to the Commission the amounts together with a statement setting out the following information in respect of every purchase of grain by the licensee during the month in which the amounts were deducted, whether or not a levy was required to be deducted in respect of the purchase:

(a) the producer’s number;

(b) the serial number of each cash purchase ticket;

(c) the date on which the grain is delivered for sale;

(d) the net weight of grain, after dockage, recorded in the permit book held by the producer;

(e) the company and station number of the place where the grain is delivered for sale;

(f) the kind of grain;

(g) the grade of grain;

(h) the gross amount of payment authorized by the cash purchase ticket; and

(i) the amount of the levy deducted, if any.

- SOR/78-125, s. 1

- SOR/79-135, s. 1

- SOR/82-570, s. 4(F)

Endorsement in Permit Book

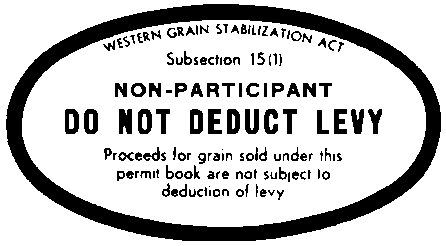

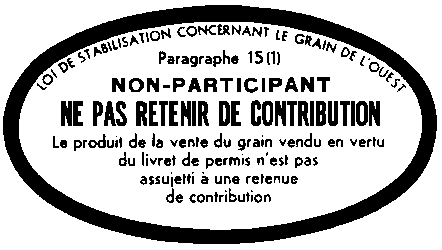

4 (1) For the purposes of subsection 15(1) of the Act, the endorsement shall be in the form set out in Schedule I.

(2) For the purposes of subsection 15(2) of the Act, the endorsement shall be in the form set out in Schedule II.

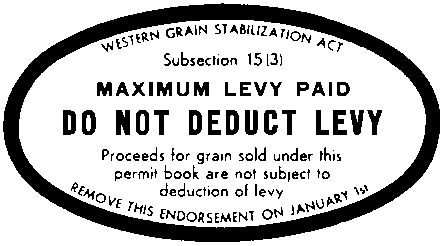

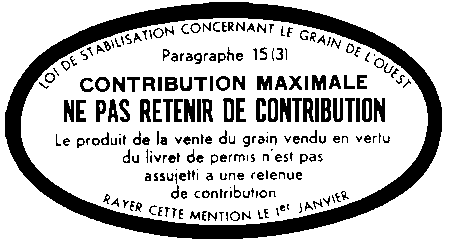

(3) For the purposes of subsection 15(3) of the Act, the endorsement shall be in the form set out in Schedule III.

Refund of Levies

5 Any refund of levy in whole or in part that is payable to a producer or to a participant under section 22 of the Act shall be paid at the end of the quarter of the year following the quarter in which the Minister determines that a refund is payable under that section.

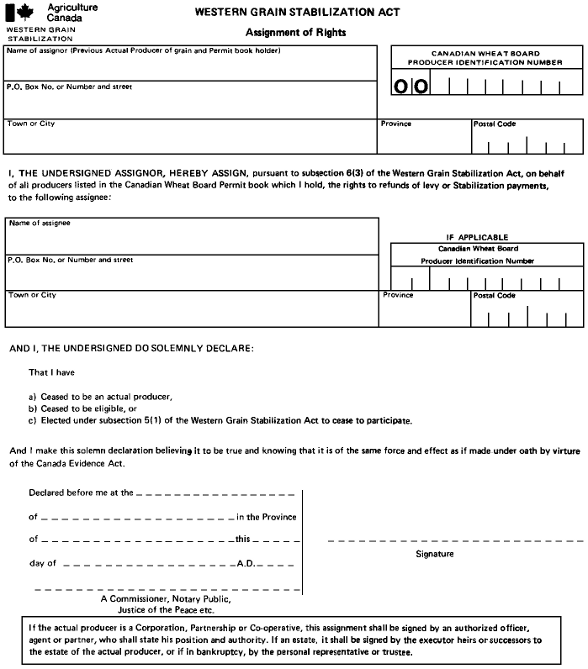

Assignment of Rights

6 For the purposes of subsection 6(3) of the Act, an assignment shall be in the form set out in Schedule IV.

Designated Purchasers

7 Any person or undertaking that purchases grain or seed for purposes of resale or processing may be designated as a purchaser for the purposes of the Act on condition that the person or undertaking is a feed mill operator or a seed company operator that

(a) maintains accounting records in accordance with generally accepted accounting standards;

(b) furnishes a receipt to each producer from whom grain is purchased showing

(i) the producer’s number,

(ii) the name and address of the producer,

(iii) the date on which the grain is delivered for sale,

(iv) the net weight of grain, after dockage, purchased,

(v) the name and address of the purchaser,

(vi) the kind of grain purchased,

(vii) the gross amount of payment made to the producer, and

(viii) the amount of the levy deducted under the Act;

(c) agrees to make available its records to the Commission for inspection; and

(d) agrees to forward to the Commission, on or before the last day of each month, a statement setting out the information referred to in paragraphs 3(a) to (i) in respect of every purchase of grain by the person or undertaking during the previous month.

- SOR/78-125, s. 2

- SOR/79-135, s. 2

- SOR/82-570, s. 5(F)

Prescription of Seed

8 Domestic mustard seed produced in the designated area is hereby prescribed as a grain for the purposes of the Act.

SCHEDULE I(Section 4)

or

SCHEDULE II(Section 4)

Western Grain Stabilization Act

Subsection 15(2)

Proceeds for grain sold under this permit book by any producer other than the actual producer are not subject to deduction of levy.

or

Loi de stabilisation concernant le grain de l’ouest

Paragraphe 15(2)

Le produit que le producteur, qui n’est pas producteur réel, tire de la vente du grain en vertu du livret de permis n’est pas assujetti à une retenue de contribution.

SCHEDULE III(Section 4)

or

SCHEDULE IV(Section 6)

- Date modified: