Lobbyists Registration Regulations (SOR/2008-116)

Full Document:

- HTMLFull Document: Lobbyists Registration Regulations (Accessibility Buttons available) |

- XMLFull Document: Lobbyists Registration Regulations [24 KB] |

- PDFFull Document: Lobbyists Registration Regulations [1463 KB]

Regulations are current to 2024-10-30 and last amended on 2012-04-27. Previous Versions

Lobbyists Registration Regulations

SOR/2008-116

Registration 2008-04-17

Lobbyists Registration Regulations

P.C. 2008-769 2008-04-17

Her Excellency the Governor General in Council, on the recommendation of the President of the Treasury Board, pursuant to section 12Footnote a of the Lobbying ActFootnote b, hereby makes the annexed Lobbyists Registration Regulations.

Return to footnote aS.C. 2006, c. 9, s. 79 and ss. 81(g)

Return to footnote bR.S., c. 44 (4th Supp.); S.C. 2006, c. 9, s. 66

Interpretation

1 The following definitions apply in these Regulations.

- Act

Act means the Lobbying Act. (Loi)

- Commissioner

Commissioner means the Commissioner of Lobbying appointed under subsection 4.1(1) of the Act. (commissaire)

- consultant lobbyist

consultant lobbyist means an individual who is required to file a return under subsection 5(1) of the Act. (lobbyiste-conseil)

- in-house lobbyist

in-house lobbyist means an employee of a corporation or organization who is named in the return filed under subsection 7(1) of the Act. (lobbyiste salarié)

- member of a transition team

member of a transition team means any person referred to in subsection 2(3) of the Act. (membre d’une équipe de transition)

Filing of Returns

2 (1) Subject to subsection (2), a return shall be filed electronically.

(2) A return may be filed in paper format if the person filing the return

(a) has difficulty filing the return electronically because of a disability; or

(b) does not have access to a computer system that allows them to file it electronically.

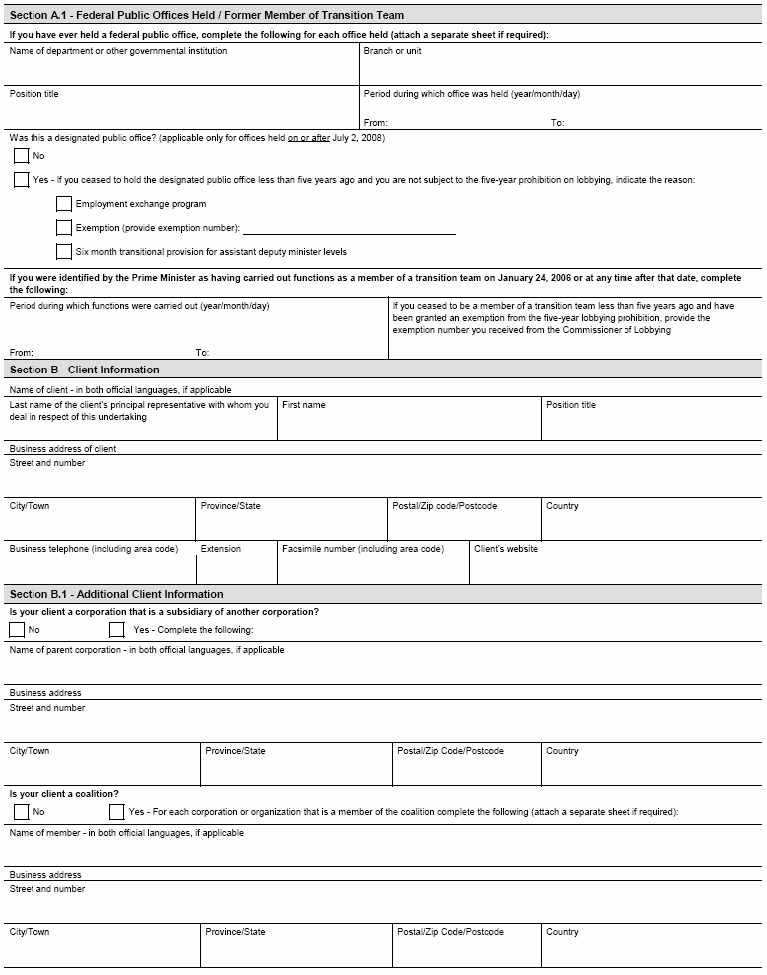

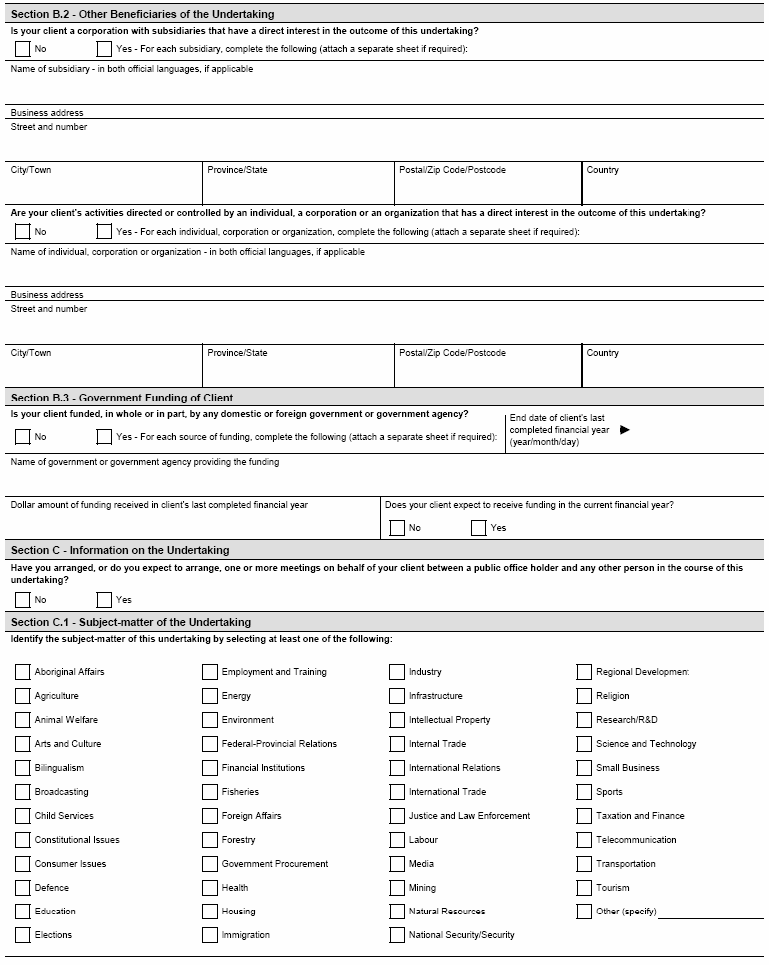

3 (1) A return referred to in section 5 of the Act that is filed in paper format shall be in Form 1 of the schedule.

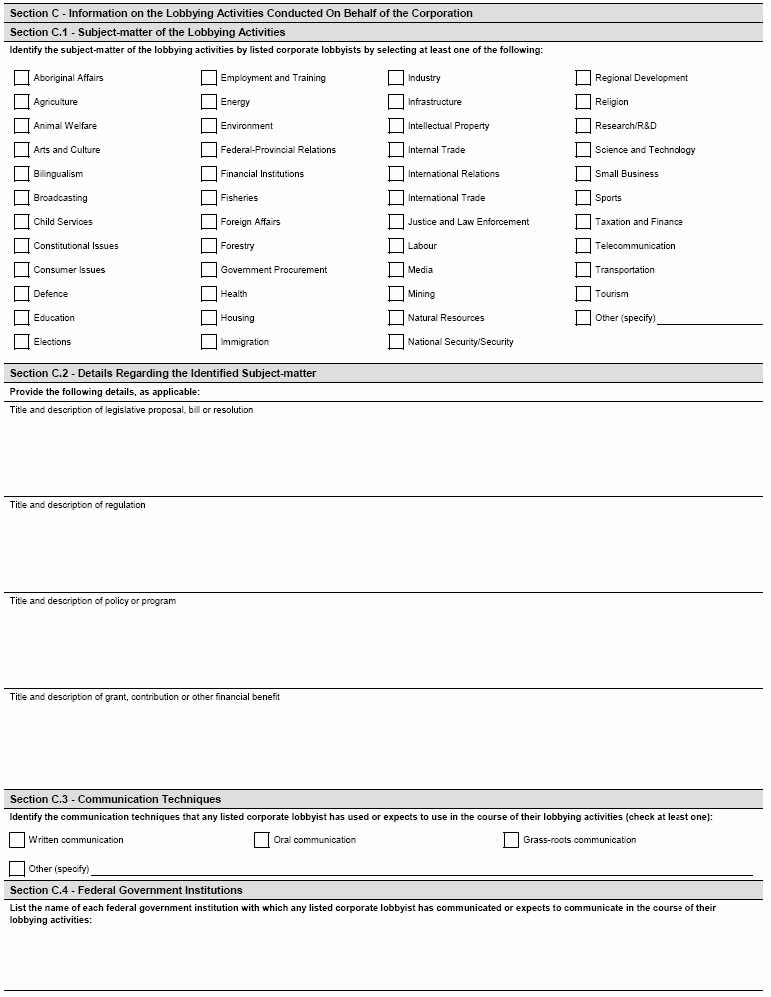

(2) A return referred to in section 7 of the Act that is filed in paper format on behalf of a corporation shall be in Form 2 of the schedule.

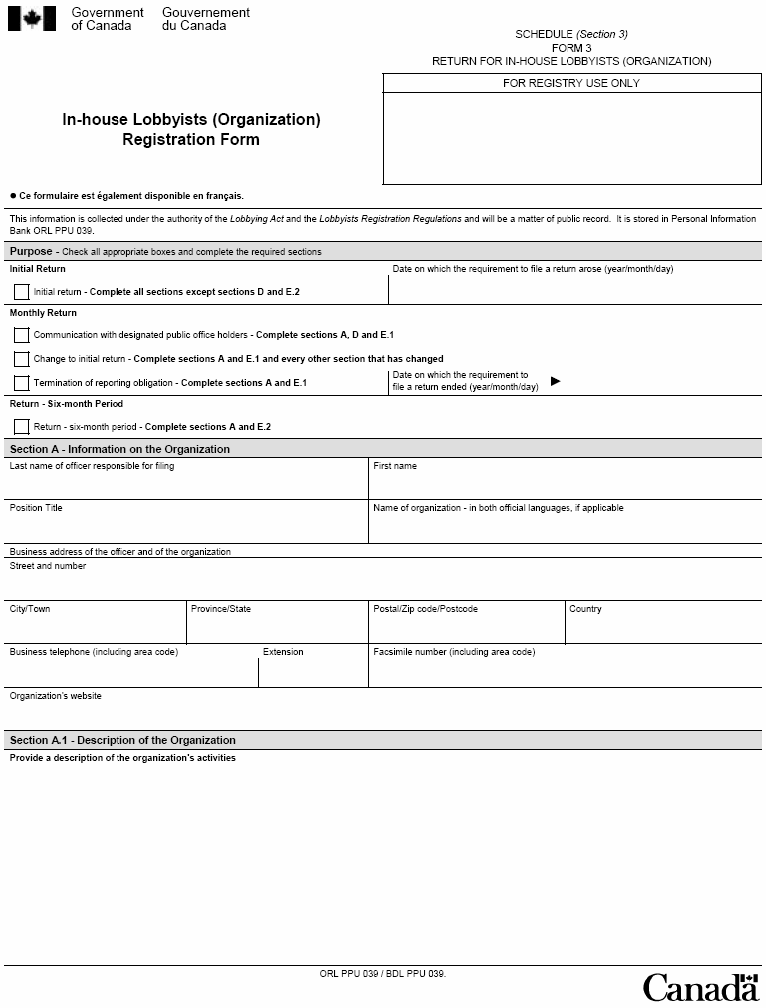

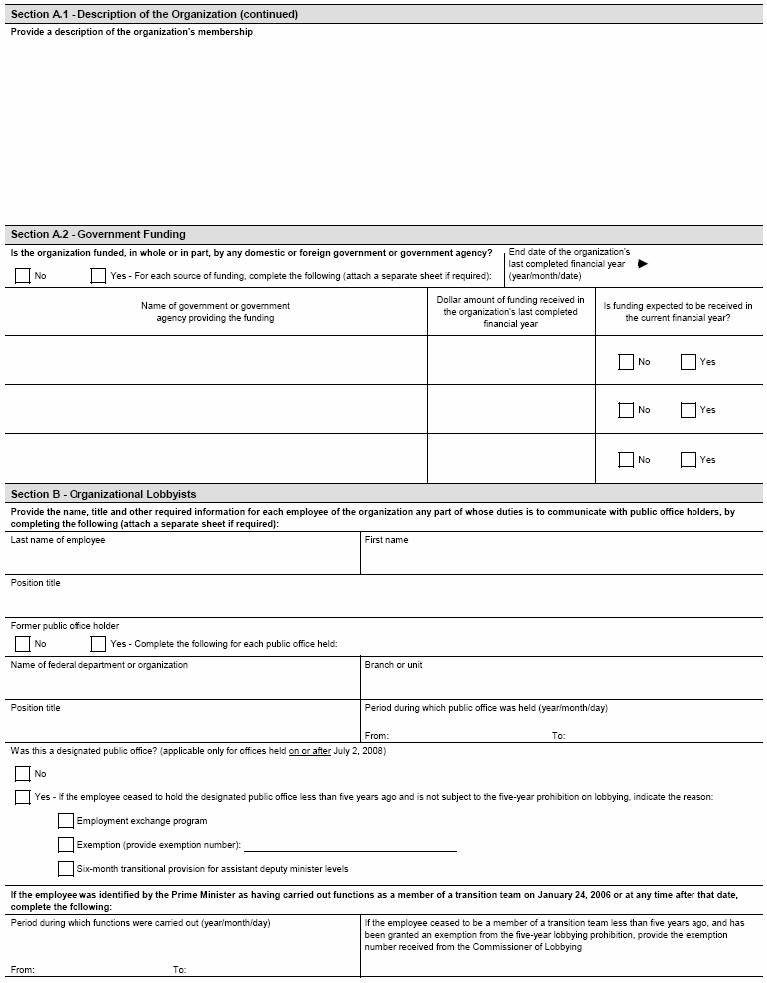

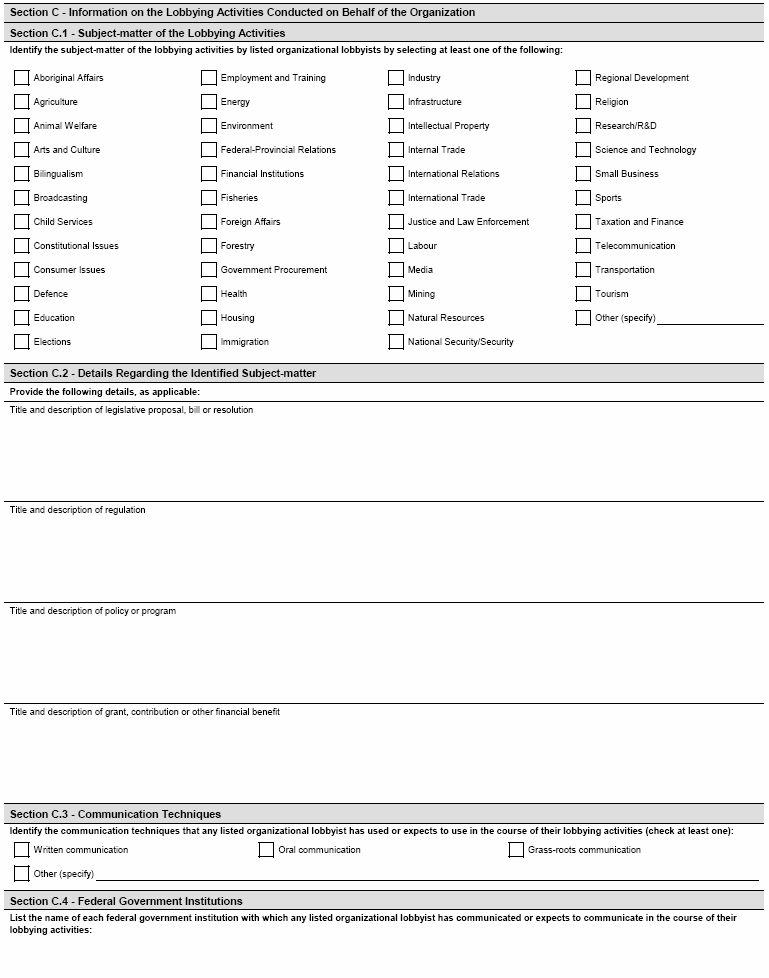

(3) A return referred to in section 7 of the Act that is filed in paper format on behalf of an organization shall be in Form 3 of the schedule.

4 (1) A return that is filed in paper format must be delivered to the Commissioner’s office by mail, by facsimile transmission or by hand.

(2) A return is deemed to have been received

(a) on the date of receipt stamped on the document by the Commissioner’s office, if the return is delivered by mail or by hand;

(b) on the date indicated by the receiving apparatus, if the return is sent by facsimile transmission; or

(c) on the date that it enters the registry of the Commissioner’s office, if the return is filed electronically.

(3) A facsimile copy of the return is deemed to be the original.

- SOR/2012-88, s. 1

Registration of Consultant Lobbyists

Initial Return

5 A consultant lobbyist shall, with respect to a return filed under subsection 5(1) of the Act, include, in addition to the information required under subsection 5(2) of the Act, the following:

(a) if the client is a corporation, whether the consultant lobbyist is a member of the board of directors of the corporation;

(b) if the client is an organization, whether the consultant lobbyist is a member of, or a member of the board of directors of, the organization;

(c) if the consultant lobbyist ceases to hold a designated public office on or after July 2, 2008 and they file the return less than five years after ceasing to hold the designated public office, whether they are subject to the five-year prohibition on lobbying set out in section 10.11 of the Act and, if not, the reason that they are not subject to it; and

(d) if the consultant lobbyist ceased to be a transition team member on or after January 24, 2006 and they file the return less than five years after ceasing to carry out those functions, whether they are subject to the five-year prohibition on lobbying set out in section 10.11 of the Act and, if not, the reason that they are not subject to it; and

(e) the name and title of the client’s principal representative with whom the consultant lobbyist deals.

Monthly Return

6 For the purposes of paragraph 5(3)(a) of the Act, the following types of communication are prescribed if made orally and arranged in advance of the communication:

(a) a communication referred to in any of subparagraphs 5(1)(a)(i) to (vi) of the Act that is initiated by a person other than a public office holder; and

(b) a communication referred to in either subparagraph 5(1)(a)(v) or (vi) that is initiated by a public office holder.

7 The consultant lobbyist shall, with respect to a return filed under subsection 5(3) of the Act, include, in addition to the information required under paragraph 5(3)(a) of the Act, the following:

(a) the position title of the designated public office holder; and

(b) the name of the branch or unit and the name of the department or other governmental institution in which the designated public office holder is employed or serves at the time of the communication.

Registration of In-house Lobbyists (Corporations and Organizations)

Initial Return

8 The officer responsible shall, with respect to a return filed under subsection 7(1) of the Act, include, in addition to the information required under subsection 7(3) of the Act, the following:

(a) if an in-house lobbyist ceases to hold a designated public office on or after July 2, 2008 but less than five years before the return is filed, whether they are subject to the five-year prohibition on lobbying under section 10.11 of the Act and, if not, the reason why they are not subject to it; or

(b) if an in-house lobbyist ceases to be a transition team member on or after January 24, 2006 but less than five years before the return is filed, whether they are subject to the five-year prohibition on lobbying under section 10.11 of the Act and, if not, the reason why they are not subject to it.

Monthly Return

9 For the purposes of subsection 7(4) of the Act, the following types of communication are prescribed if made orally and arranged in advance of the communication:

(a) a communication referred to in any of subparagraphs 7(1)(a)(i) to (v) of the Act that is initiated by a person other than a public office holder; and

(b) a communication referred to in subparagraph 7(1)(a)(v) of the Act that is initiated by a public office holder.

10 The officer responsible for filing shall, with respect to a return filed under subsection 7(4) of the Act, include, in addition to the information required under paragraph 7(4)(a) of the Act, the following:

(a) the position title of the designated public office holder; and

(b) the name of the branch or unit and the name of the department or other governmental institution in which the designated public office holder is employed or serves at the time of the communication.

Clarification or Correction of Returns

11 (1) Any clarification to a return requested by the Commissioner under subsection 9(3.1) of the Act shall be provided by the individual who submitted the return, not later than 30 days after the day on which the request is made.

(2) Any correction to a return requested by the Commissioner under subsection 9(3.1) of the Act shall be provided by the individual who submitted the return, not later than 10 days after the day on which the request is made.

(3) A request made by the Commissioner is deemed to have been made

(a) on the date that it is post marked, if the request is mailed;

(b) on the date that it is delivered, if the request is delivered by hand;

(c) on the date indicated by the receiving apparatus, if the request is sent by facsimile transmission; or

(d) on the date of transmission, if the request is sent by electronic mail.

(4) A clarification or correction to a return is deemed to have been received

(a) on the date of receipt stamped on the document by the Commissioner’s office, if the clarification or correction to the return is delivered by mail or by hand;

(b) on the date indicated by the receiving apparatus, if the clarification or correction to the return is sent by facsimile transmission; or

(c) on the date of transmission, if the clarification or correction to the return is sent by electronic mail.

- SOR/2012-88, s. 2

Repeal

12 [Repeal]

Coming into Force

13 These Regulations come into force on July 2, 2008.

SCHEDULE(Section 3)

- SOR/2012-88, s. 3(F)

- Date modified: