Pension Diversion Regulations

SOR/84-48

GARNISHMENT, ATTACHMENT AND PENSION DIVERSION ACT

Registration 1983-12-22

Regulations Respecting Diversion of Pension Benefits to Satisfy Financial Support Orders

P.C. 1983-4086 1983-12-22

His Excellency the Governor General in Council, on the recommendation of the Minister of Justice, pursuant to sections 22, 24, 25, 27 and 36 of the Garnishment, Attachment and Pension Diversion ActFootnote *, is pleased hereby to make the annexed Regulations respecting diversion of pension benefits to satisfy financial support orders.

Return to footnote *S.C. 1980-81-82-83, c. 100

Short Title

1 These Regulations may be cited as the Pension Diversion Regulations.

Definitions

2 The definitions in this section apply in these Regulations.

- Act

Act means the Garnishment, Attachment and Pension Diversion Act. (Loi)

- plan member

plan member means a person who is or may be entitled to a pension benefit under the Public Service Superannuation Act and against whom there is a financial support order. (participant au régime)

- SOR/97-177, s. 1

Prescription of Information To Be Contained in an Application

3 (1) An application referred to in subsection 33(1) of the Act shall be signed by the applicant and shall contain the following information:

(a) in respect of a recipient,

(i) the recipient’s

(A) surname and given names,

(B) date of birth,

(C) most recent address known to the applicant or the person making the application and the year that the recipient was known to reside at that address,

(D) social insurance number or regimental number, if known,

(E) previous surname, if applicable,

(F) pension, annuity or superannuation number, if known,

(G) most recent place of employment in the public service of Canada known to the applicant or the person making the application, and

(H) most recent year of employment in the public service of Canada known to the applicant or the person making the application,

(ii) each enactment referred to in the schedule to the Act pursuant to which a pension benefit is payable to the recipient, if known, and

(iii) any other relevant information that would aid in establishing the identification of the recipient;

(b) in respect of an applicant, the applicant’s

(i) surname and given names,

(ii) place of residence at the time the application is made, and

(iii) mailing address;

(c) where the applicant is in the custody and control of another person, the full name and address of the other person;

(d) where the application is made through another person acting on behalf of the applicant, the full name and address of the other person and the other person’s legal relationship to the applicant;

(e) where a diversion payment is to be made to a person designated in a financial support order, other than the applicant, the full name and address of that person; and

(f) the amount payable under the financial support order by way of either periodic payments or lump sum payment, or a combination of both, at the time the application is made.

(2) Where a person who makes an application referred to in subsection 33(1) of the Act is unable to provide the date of birth of the recipient but does provide other information sufficient to enable the Minister to identify the recipient within a reasonable time, the requirement that the application contain the date of birth of the recipient shall be waived.

- SOR/85-511, s. 1

- SOR/87-666, s. 1

- SOR/97-177, s. 2

Prescription of Additional Documentation To Be Contained in an Application

4 An application referred to in subsection 33(1) of the Act shall, in addition to containing the information required by section 3, be accompanied by the following documentation:

(a) where an applicant’s name is different from the name shown on the financial support order

(i) a certified copy of the certificate evidencing the change where a formal change of name has occurred, or

(ii) a statutory declaration by the person making the application as to the circumstances concerning the difference in any other case;

(b) where the financial support order identifies a child as entitled to support under the order and the child is an applicant, the child’s birth certificate or a certified copy thereof; and

(c) where an applicant is in the custody and control of another person, a certified copy of any relevant court order or a statutory declaration by the other person as to the circumstances concerning the custody and control of the applicant.

- SOR/87-666, s. 2

- SOR/97-177, s. 3

Mailing Address for Applications

5 An application referred to in subsection 33(1) of the Act shall be mailed,

(a) where the recipient was a member of the Canadian Forces, to

The Minister of National Defence

Director of Pay Services

Attention: DPS4

Department of National Defence

Ottawa, Ontario

K1A 0K2;

(b) where the recipient was a Judge to whom the Judges Act applies, to

The Minister of Justice

Attention: General Counsel, Legal Services

Department of Public Works and Government Services

Ottawa, Ontario

K1A 0S5;

(c) where the recipient was a member of the Senate, to

The Minister of Finance

Attention: Director, Administration & Personnel

The Senate

Parliament Buildings

Ottawa, Ontario

K1A 0A4;

(d) where the recipient was a member of the House of Commons, to

The Minister of Finance

Attention: Manager

House of Commons District Services Office

Room 2310, Main Building

Tunney’s Pasture

Ottawa, Ontario

K1A 1G7; and

(e) in any other case, or in cases of doubt, to

The Minister of Public Works and Government Services

Attention: General Counsel, Legal Services

Department of Public Works and Government Services

Ottawa, Ontario

K1A 0S5

- SOR/97-177, s. 4

Applications Received for Which There is no Recipient

6 Where an application referred to in subsection 33(1) of the Act is received and the person named as a recipient in the application is not a recipient as defined by subsection 32(1) of the Act at that time, the application shall be retained by the Minister for a period of 12 months.

- SOR/97-177, s. 5

Prescription of Information To Be Contained in and Manner of Sending a Notification to Recipient

7 A notification referred to in section 34 of the Act shall

(a) contain a statement that

(i) a duly completed application for diversion of the recipient’s pension benefit has been received for or on behalf of named persons, domiciled and ordinarily resident at the time of the application in a stated province, territory or foreign country or place,

(ii) the address of the recipient stated in the notification is the address that will be used by the Minister for purposes of any diversion,

(iii) a diversion of a stated amount or stated portion of the net pension benefit will be made to the applicant no later than a stated date, and

(iv) the recipient may at any time apply to the Minister in accordance with the Act and these Regulations for a variation or termination of the diversion;

(b) be accompanied by a copy of the financial support order on which the application is based; and

(c) be sent

(i) where the latest known address of the recipient is in Canada, by registered mail with an acknowledgement of receipt, and

(ii) in any other case, by air mail or other similar means.

- SOR/97-177, s. 6

Amount To Be Diverted

8 Where a recipient’s pension benefit consists of both a lump sum payment and periodic payments and the lump sum payment is payable in advance of any periodic payment, the amount to be diverted from the recipient’s net pension benefit shall be determined in accordance with the relevant provisions of the Act as if there were only one such type of payment at the relevant time.

9 Where a recipient’s pension benefit consists of both a lump sum payment and periodic payments and the lump sum payment is payable at the same time as any periodic payment, the amount to be diverted from the recipient’s net pension benefit shall be governed by the following rules:

(a) where the relevant financial support order provides only for a lump sum payment, the amount specified in the order shall first be satisfied out of the lump sum portion of the recipient’s net pension benefit in accordance with section 36 of the Act as if the recipient’s pension benefit consisted only of a lump sum payment and, if any amount thereof remains unsatisfied, that amount shall be treated as a new lump sum payment to be satisfied in accordance with section 37 of the Act as if the recipient’s pension benefit consisted only of periodic payments;

(b) where the relevant financial support order provides only for periodic payments, the payments shall be satisfied out of the periodic payments of the recipient’s net pension benefit in accordance with section 36 of the Act as if the recipient’s pension benefit consisted only of periodic payments; and

(c) where the relevant financial support order provides for both a lump sum payment and periodic payments, the lump sum payment portion shall be satisfied out of the lump sum payment portion of the recipient’s net pension benefit in accordance with section 36 of the Act as if the recipient’s pension benefit consisted only of a lump sum payment and the periodic payments shall be satisfied out of the periodic payments portion of the recipient’s net pension benefit in accordance with section 36 of the Act as if the recipient’s pension benefit consisted only of periodic payments.

- SOR/97-177, s. 7

9.1 (1) In this section, applicant’s proportionate share means, in respect of an applicant, the quotient obtained by dividing the amount specified in the financial support order of the applicant by the sum of the amounts specified in the financial support orders accompanying the two or more duly completed applications for diversion referred to in subsection (3) or (4).

(2) This section applies where two or more duly completed applications for diversion of a recipient’s net pension benefit are received before a diversion is made or where a diversion of a recipient’s net pension benefit is being made and another duly completed application for diversion of the pension benefit is received.

(3) Where two or more duly completed applications for diversion of a recipient’s net pension are received and the portion of the recipient’s net pension benefit subject to diversion pursuant to sections 36 to 40.1 of the Act is, in respect of each applicant, the same, the amount of the net pension benefit to be diverted to each applicant shall be that portion of the net pension benefit multiplied by the applicant’s proportionate share, to a maximum of the amount specified in the financial support order of the applicant.

(4) Where two or more duly completed applications for diversion of a recipient’s net pension benefit are received and the portion of the recipient’s net pension benefit subject to diversion pursuant to sections 36 to 40.1 of the Act is not, in respect of each applicant, the same, the amount of the net pension benefit to be diverted to each applicant shall be

(a) if the sum of the amounts specified in the financial support orders accompanying the applications is equal to or less than the net pension benefit, an amount equal to the amount that would be diverted to that applicant had that applicant been a sole applicant under the Act; or

(b) if the sum of the amounts specified in the financial support orders accompanying the applications is greater than the net pension benefit, the net pension benefit multiplied by each applicant’s proportionate share, to a maximum of the net pension benefit that would be diverted to that applicant had that applicant been a sole applicant under the Act.

(5) Where the amount of the recipient’s net pension benefit to be diverted to an applicant pursuant to paragraph (4)(b) is less than the maximum referred to in that paragraph, the amount, not to exceed that maximum, to be diverted to that applicant shall be equal to

(a) the amount diverted to that applicant pursuant to paragraph (4)(b); and

(b) the amount of the difference, if any, between the sum of the amounts to be diverted to each applicant from that net pension benefit pursuant to paragraph (4)(b) and the net pension benefit subject to diversion pursuant to sections 36 to 40.1 of the Act.

- SOR/85-511, s. 2

- SOR/97-177, s. 8

10 [Repealed, SOR/97-177, s. 9]

Applications for Variation or Termination

11 (1) An application, pursuant to subsection 41(1) of the Act, for a variation in the amount being diverted with respect to a diversion may be made on the grounds that

(a) the financial support order on which the diversion is based has been varied or replaced by another financial support order that would change the amount to be diverted as calculated in accordance with the Act and these Regulations;

(b) there is a change in the applicant’s or recipient’s place of ordinary residence that would change the amount to be diverted as calculated in accordance with the Act and these Regulations;

(c) there is a change in the status of a person on whose behalf diversion payments are being made to another person;

(d) there is a change in a condition of payment specified in the financial support order on which the diversion is based that changes the amount to be paid pursuant to the order; or

(e) a written request to reduce the amount being diverted has been made by and signed by the applicant or the person to whom diversion payments are being made for the benefit of the applicant.

(2) An application, pursuant to subsection 41(1) of the Act, for termination of a diversion may be made on the grounds that

(a) there is a change in a condition of payment specified in the financial support order on which the diversion is based that has the effect of terminating the order;

(b) the order is terminated, rescinded or nullified by another order or a judgment of a court; or

(c) a written request to terminate the diversion has been made by and signed by the applicant or the person to whom diversion payments are being made for the benefit of the applicant.

(3) An application referred to in subsection (1) or (2) shall contain

(a) a written request for a variation in the amount being diverted or for termination of the diversion, as the case may be,

(b) sufficient information to enable the Minister to identify the applicant and recipient,

(c) a statement of the grounds for the application, and

(d) written evidence of the facts alleged concerning the application sufficient to permit the Minister to ascertain the truth of the facts,

and shall be signed by or on behalf of the applicant or recipient.

- SOR/87-666, s. 3(E)

- SOR/97-177, s. 10

Prescription of Deductions from Pension Benefits

12 For the purposes of the definition net pension benefit in subsection 32(1) of the Act, the prescribed deductions shall be

(a) any arrears of income tax required to be retained pursuant to section 224.1 of the Income Tax Act and any amount required to be withheld as income tax in relation to a recipient domiciled outside of Canada or in relation to a lump sum payment;

(b) any amount deducted from the recipient’s pension benefit for shortage of current pension contributions, arrears of contributions for elective service and shortage of arrears of pension contributions;

(c) any amount deducted from the recipient’s pension benefit pursuant to an Act of Parliament, but not including

(i) income tax, other than the income tax deduction set out in paragraph (a), and

(ii) any pension diversion made pursuant to Part II of the Act;

(d) any amount deducted from the recipient’s pension benefit as a premium payment for a health care or hospital insurance plan;

(e) any amount deducted from the recipient’s pension benefit as a premium payment for a group life insurance plan listed in Schedule I; and

(f) any amount deducted from the recipient’s pension benefit for supplementary death benefit contributions or shortages of such contributions.

- SOR/85-511, s. 3

- SOR/97-177, s. 11

Prescription of the Time for Filing and the Information To Be Contained in an Annual Statement

13 A written statement referred to in subsection 37(3) of the Act shall

(a) be filed within 30 days after the anniversary date of the commencement of the diversion payments;

(b) contain information as to whether or not, to the knowledge of the applicant,

(i) the financial support order has been replaced or varied by any other order,

(ii) the financial support order has been satisfied by the diversion payments made, by any other means or by any combination thereof, and

(iii) the conditions of payment in the financial support order, if any, are still applicable; and

(c) be witnessed by a person who knows the applicant.

- SOR/87-666, s. 4

- SOR/97-177, s. 12

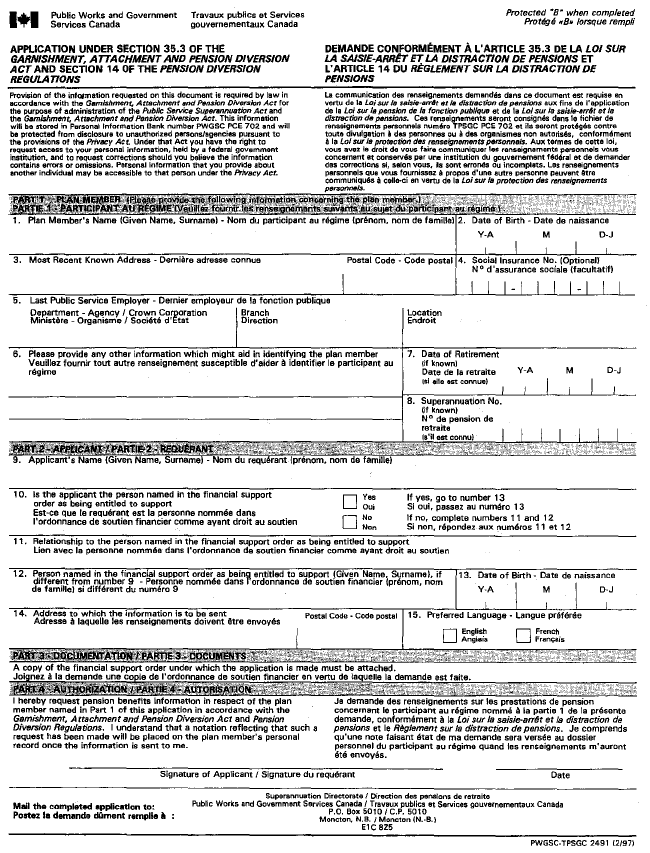

Application for Information Under Section 35.3 of the Act

14 An application under section 35.3 of the Act shall be made in the form set out in Schedule II and be accompanied by a certified true copy of the financial support order.

- SOR/97-177, s. 13

15 Where a person who makes an application referred to in section 35.3 of the Act is unable to provide the date of birth of the plan member but does provide other information sufficient to enable the Minister to identify the plan member within a reasonable time, the requirement that the application contain the date of birth of the plan member shall be waived.

- SOR/97-177, s. 13

16 An application referred to in section 35.3 of the Act shall be mailed to:

Superannuation Directorate

Department of Public Works and Government Services

P.O. Box 5010

Moncton, New Brunswick

E1C 8Z5

- SOR/97-177, s. 13

17 Where an application is made pursuant to section 35.3 of the Act, the Minister shall provide the following information to the person making the application:

(a) the date on which the plan member ceased to be employed in the Public Service and the period of pensionable service to the credit of the plan member;

(b) the date of birth of the plan member;

(c) whether the plan member is, at the time of the application, eligible to exercise an option for a benefit under the Public Service Superannuation Act;

(d) whether the plan member has made such an option and, if so, the details of the option;

(e) if the plan member has not exercised such an option, the last day for exercising that option;

(f) the amount of the deferred annuity that the plan member would be entitled to receive;

(g) the annual allowance that the plan member would be entitled to receive had the member made an option for that benefit on the date of providing the information; and

(h) the date on which the information is provided.

- SOR/97-177, s. 13

18 Where an application referred to in section 35.3 of the Act is received and the person named as a plan member in the application has not yet exercised an option under section 12 or 13 of the Public Service Superannuation Act, the application shall be retained by the Minister for a period of 12 months and the Minister shall inform the person who made the application of any option exercised by the plan member during that 12-month period.

- SOR/97-177, s. 13

SCHEDULE I(Section 12)Group Life Insurance Plans Listed for the Purposes of Section 12

1 A group life insurance plan established pursuant to one of the following enactments:

(a) the Civil Service Insurance Act;

(b) the Returned Soldiers’ Insurance Act; or

(c) the Veterans Insurance Act.

2 The Royal Canadian Mounted Police Group Life Insurance — Basic Plan, Optional Plan and Optional Dependents Plan.

3 A life insurance plan with the Civil Service Mutual Benefit Society, a body corporate with offices at Ottawa.

- SOR/97-177, s. 15

SCHEDULE II(Section 14)

- SOR/97-177, s. 16

- Date modified: