Consumer Packaging and Labelling Regulations (C.R.C., c. 417)

Full Document:

- HTMLFull Document: Consumer Packaging and Labelling Regulations (Accessibility Buttons available) |

- XMLFull Document: Consumer Packaging and Labelling Regulations [135 KB] |

- PDFFull Document: Consumer Packaging and Labelling Regulations [287 KB]

Regulations are current to 2024-11-26 and last amended on 2019-06-17. Previous Versions

Consumer Packaging and Labelling Regulations

C.R.C., c. 417

CONSUMER PACKAGING AND LABELLING ACT

Regulations Respecting Consumer Packaging and Labelling

Short Title

1 These Regulations may be cited as the Consumer Packaging and Labelling Regulations.

Interpretation

2 (1) In these Regulations,

- Act

Act means the Consumer Packaging and Labelling Act; (Loi)

- Canadian unit

Canadian unit means a unit of measurement set out in Schedule II to the Weights and Measures Act; (unité canadienne)

- declaration of net quantity

declaration of net quantity means the declaration of net quantity referred to in section 4 of the Act; (déclaration de quantité nette)

- metric unit

metric unit means a unit of measurement set out in Schedule I to the Weights and Measures Act; (unité métrique)

- nominal volume

nominal volume[Repealed, SOR/96-278, s. 1]

- ornamental container

ornamental container means a container that, except on the bottom, does not have any promotional or advertising material thereon, other than a trademark or common name and that, because of any design appearing on its surface or because of its shape or texture, appears to be a decorative ornament and is sold as a decorative ornament in addition to being sold as the container of a product; (emballage décoratif)

- principal display surface

principal display surface means,

(a) in the case of a container that has a side or surface that is displayed or visible under normal or customary conditions of sale or use, the total area of such side or surface excluding the top, if any,

(b) in the case of a container that has a lid that is the part of the container displayed or visible under normal or customary conditions of sale or use, the total area of the top surface of the lid,

(c) in the case of a container that does not have a particular side or surface that is displayed or visible under normal or customary conditions of sale or use, any 40 per cent of the total surface area of the container, excluding the top and bottom, if any, if such 40 per cent can be displayed or visible under normal or customary conditions of sale or use,

(d) in the case of a container that is a bag with sides of equal dimensions, the total area of one of the sides,

(e) in the case of a container that is a bag with sides of more than one size, the total area of one of the largest sides,

(f) in the case of a container that is a wrapper or confining band that is so narrow in relation to the size of the product contained that it cannot reasonably be said to have any side or surface that is displayed or visible under normal or customary conditions of sale or use, the total area of one side of a ticket or tag attached to such container, and

(g) despite paragraphs (a) to (f) of this definition, in the case of a container of wine in which the wine is displayed for sale to consumers, any part of the surface of the container, excluding its top and bottom, that can be seen without having to turn the container. (principale surface exposée)

- wine

wine[Repealed, SOR/2018-108, s. 379]

(2) For the purposes of the Act and these Regulations,

- principal display panel

principal display panel means,

(a) in the case of a container that is mounted on a display card, that part of the label applied to all or part of the principal display surface of the container or to all or part of the side of the display card that is displayed or visible under normal or customary conditions of sale or use or to both such parts of the container and the display card,

(b) in the case of an ornamental container, that part of the label applied to all or part of the bottom of the container or to all or part of the principal display surface or to all or part of a tag that is attached to the container, and

(c) in the case of all other containers, that part of the label applied to all or part of the principal display surface. (espace principal)

- SOR/96-278, s. 1

- 2014, c. 20, s. 366(E)

- SOR/2014-8, s. 1

- SOR/2018-108, s. 379

Exemptions from All Provisions of the Act

3 (1) Prepackaged products that are produced or manufactured for commercial or industrial enterprises or institutions for use by such enterprises or institutions without being sold by them as prepackaged products to other consumers are exempt from all the provisions of the Act.

(2) Prepackaged products that are produced or manufactured only for export or for sale to a duty-free store, are exempt from all the provisions of the Act.

(3) Prepackaged products consisting of consumer textile articles that are subject to section 3 of the Textile Labelling Act are exempt from all the provisions of the Act.

(4) Prepackaged products consisting of replacement parts for vehicles, appliances or other durable consumer goods are exempt from all the provisions of the Act unless they are intended to be displayed for sale to a consumer or are displayed for sale to a consumer.

(5) Prepackaged products consisting of materials that are produced or manufactured for use by artists, namely,

(a) colours for painting, dyeing or printing,

(b) ceramic and enamelling colours and glazes, and

(c) surfaces and tools,

are exempt from all the provisions of the Act.

Exemptions from Sections 4, 5, 6 and 10 of the Act

4 Prepackaged products that are subject to regulations respecting packaging, labelling and marking under the Feeds Act, Fertilizers Act, Seeds Act or Pest Control Products Act are exempt from sections 4, 5, 6 and 10 of the Act.

Exemptions from Section 4 and Subparagraph 10(b)(ii) of the Act

5 (1) A prepackaged product that

(a) [Repealed, SOR/2018-108, s. 381]

(b) is usually sold to a consumer by numerical count,

(c) is packaged in such a manner that the product contents are visible and identifiable, and

(d) has a label applied to it in accordance with sections 7 to 11 that shows the information referred to in subparagraph 10(b)(i) of the Act in the form and manner prescribed by these Regulations,

is exempt from subparagraph 10(b)(ii) of the Act.

(2) A prepackaged product that

(a) [Repealed, SOR/2018-108, s. 381]

(b) is usually sold to a consumer by numerical count,

(c) is packaged in such a manner that the product contents are visible and identifiable,

(d) consists of less than seven articles or consists of less than 13 articles and the actual number of those articles can be readily ascertained by an examination of the product without opening it, and

(e) has a label applied to it in accordance with sections 7 to 11 that shows the information referred to in subparagraph 10(b)(i) of the Act in the form and manner prescribed by these Regulations,

is exempt from section 4 of the Act.

(3) A prepackaged product that

(a) [Repealed, SOR/2018-108, s. 381]

(b) consists of a single article or consists of more than one article where the articles are packaged as a set,

(c) is usually sold to a consumer by numerical count,

(d) has on the principal display panel a pictorial representation which adequately indicates the identity and quantity of the product contents, and

(e) has a label applied to it in accordance with sections 7 to 11 that shows the information referred to in subparagraph 10(b)(i) of the Act in the form and manner prescribed by these Regulations,

is exempt from section 4 and subparagraph 10(b)(ii) of the Act.

5.1 [Repealed, SOR/96-278, s. 2]

Bilingual Requirements and Exemptions

6 (1) In this section,

- local government unit

local government unit means a city, metropolitan government area, town, village, municipality or other area of local government but does not include any local government unit situated within a bilingual district established under the Official Languages Act; (collectivité locale)

- local product

local product means a prepackaged product that is manufactured, processed, produced or packaged in a local government unit and sold only in

(a) the local government unit in which it is manufactured, processed, produced or packaged,

(b) one or more local government units that are immediately adjacent to the one in which it is manufactured, processed, produced or packaged, or

(c) the local government unit in which it is manufactured, processed, produced or packaged and in one or more local government units that are immediately adjacent to the one in which it is manufactured, processed, produced or packaged; (produit local)

- mother tongue

mother tongue means the language first learned in childhood by persons in any area of Canada and still understood by them as ascertained by the decennial census taken immediately preceding the date on which the prepackaged product referred to in subsection (3) is sold to the consumer; (langue maternelle)

- official languages

official languages means the English language and the French language; (langues officielles)

- specialty product

specialty product means a prepackaged product that is an imported product

(a) that is not widely used by the population as a whole in Canada; and

(b) for which there is no readily available substitute that is manufactured, processed, produced or packaged in Canada and that is generally accepted as being a comparable substitute; (produit spécial)

- test market product

test market product means a prepackaged product that, prior to the date of the notice of intention respecting that product referred to in subsection (5), was not sold in Canada in that form and that differs substantially from any other product sold in Canada with respect to its composition, function, state or packaging form. (produit d’essai)

(2) All information required by the Act and these Regulations to be shown on the label of a prepackaged product shall be shown in both official languages except that the identity and principal place of business of the person by or for whom the prepackaged product was manufactured, processed, produced or packaged for resale may be shown in one of the official languages.

(3) Subject to subsections (4) to (6), a local product or test market product is exempt from subsection (2) if

(a) it is sold in a local government unit in which one of the official languages is the mother tongue of less than 10 per cent of the total number of persons residing in the local government unit; and

(b) the information required by the Act and these Regulations to be shown on the label of a prepackaged product is shown in the official language that is the mother tongue of at least 10 per cent of the total number of persons residing in the local government unit.

(4) Where one of the official languages is the mother tongue of less than 10 per cent of the total number of persons residing in a local government unit and the other official language is the mother tongue of less than 10 per cent of the total number of persons residing in the same local government unit, subsection (3) does not apply.

(5) Subsection (3) does not apply to a test market product unless the dealer who intends to conduct the test marketing of the product has, six weeks prior to conducting the test marketing, filed with the Minister of Consumer and Corporate Affairs a notice of intention in such form as the Minister may prescribe.

(6) A test market product shall, for the purposes of subsection (3) and paragraph 36(3)(a), cease to be a test market product upon the expiration of 12 cumulative months after the date on which it was first offered for sale as a test market product but any test market product that was acquired for resale by a dealer, other than the dealer who filed the notice of intention referred to in subsection (5), before the expiration of those 12 cumulative months, shall continue to be a test market product for the purposes of subsection (3) and paragraph 36(3)(a) until it is sold to a consumer.

(7) A specialty product is exempt from subsection (2) if the information required by the Act and these Regulations to be shown on the label of a prepackaged product is shown in one of the official languages.

(8) Where there are one or more surfaces on the label of a prepackaged product that are of at least the same size and prominence as the principal display panel, the information required by the Act and these Regulations to be shown on the principal display panel may be shown in one official language if such information is shown in the other official language on one of those other surfaces.

(9) A prepackaged product that is within one of the following classes of prepackaged products is exempt from subsection (2) if the information required by the Act and these Regulations to be shown on the label of a prepackaged product is shown in the language that is appropriate to the product:

(a) greeting cards;

(b) books;

(c) talking toys;

(d) games in which a knowledge of the language used is a basic factor essential to the use of the game.

Application of Label to Prepackaged Product

7 (1) Subject to subsection (2), the label of a prepackaged product shall be applied to the container in which the product is displayed for sale to the consumer.

(2) Where the container of a prepackaged product is mounted on a display card, the label may be applied to the side of the display card that is displayed or visible under normal or customary conditions of sale or use.

8 Where the container of a prepackaged product is a wrapper or confining band referred to in paragraph (f) of the definition principal display surface in subsection 2(1), the label shall be a ticket or tag and shall be attached to the wrapper or confining band.

9 Subject to subsection 7(2) and section 10, all or part of the label of a prepackaged product shall be applied to the principal display surface of the container of that product.

10 Where the container of a prepackaged product is an ornamental container, all of the label of the prepackaged product may be applied to the bottom of the container or to a tag that is attached to the container.

11 The label of a prepackaged product shall be applied in such a manner that the prepackaged product will bear the label at the time it is sold to the consumer.

Part of Label on Which Information to Be Shown

12 The following information shall be shown on the principal display panel:

(a) the net quantity of the prepackaged product;

(b) the identity of the prepackaged product in terms of its common or generic name or in terms of its function; and

(c) such other information required by the Act or these Regulations to be shown on the principal display panel.

13 Subject to section 10, the identity and principal place of business of the person by or for whom a prepackaged product was manufactured or produced for resale shall be shown on any part of the label except that part of the label, if any, applied to the bottom of a container.

Size of Type in Which Information to Be Shown

14 (1) For the purposes of this section and sections 15 and 16, the height of a letter means the height of an upper case letter where words appear in upper case and the height of the lower case letter “o” when words appear in lower case or in a mixture of upper and lower case.

(2) The numerical quantity in the declaration of net quantity shall be shown in bold face type in letters of not less than the following height:

(a) 1/16 inch (1.6 millimetres), where the principal display surface of the container is not more than five square inches (32 square centimetres);

(b) 1/8 inch (3.2 millimetres), where the principal display surface of the container is more than five square inches (32 square centimetres) but not more than 40 square inches (258 square centimetres);

(c) 1/4 inch (6.4 millimetres), where the principal display surface of the container is more than 40 square inches (258 square centimetres) but not more than 100 square inches (645 square centimetres);

(d) 3/8 inch (9.5 millimetres), where the principal display surface of the container is more than 100 square inches (645 square centimetres) but not more than 400 square inches (25.8 square decimetres); and

(e) 1/2 inch (12.7 millimetres), where the principal display surface of the container is more than 400 square inches (25.8 square decimetres).

(3) Where a container is mounted on a display card, the declaration of net quantity may be shown on the principal display panel of the label applied to the container or on the principal display panel of the label applied to the display card but the height of the letters in the numerical quantity of the declaration of net quantity shall, for the purpose of subsection (2), be proportionate to the total area of the side of the display card that is displayed or visible under normal or customary conditions of sale or use and not to the principal display surface of the container.

(4) All information in the declaration of net quantity other than the information referred to in subsection (2), shall be shown in letters of not less than 1/16 inch (1.6 millimetres) in height.

(5) [Repealed, SOR/2018-108, s. 383]

- SOR/2014-8, s. 2

- SOR/2018-108, s. 383

15 Information that is required by the Act and these Regulations to be shown on a label, other than in the declaration of net quantity, shall be shown in a manner easily legible to the consumer under normal or customary conditions of sale or use and shall be in letters of not less than 1/16 inch (1.6 millimetres) in height.

16 Notwithstanding section 15, where the area of the principal display surface of a container is 1.55 square inches (10 square centimetres) or less, and where all the information that is required by the Act or these Regulations to be shown on a label is shown on the principal display panel, such information, other than the information in the declaration of net quantity, may be in letters of not less than 1/32 inch (0.8 millimetre) in height.

Declaration of Net Quantity

17 Where the declaration of net quantity is in terms of metric and Canadian units, those units shall be grouped together, except that any symbol that is required to be shown pursuant to the Hazardous Products Act or any regulations made under that Act may be shown between and immediately adjacent to those units.

18 [Repealed, SOR/2018-108, s. 384]

Exemption from Metric Net Quantity Declaration and Type Size Requirement

19 (1) For the purposes of this section,

- area

area means an area within the meaning of subsection 337(1) of the Weights and Measures Regulations; (région)

- floor covering

floor covering means floor covering within the meaning of section 342 of the Weights and Measures Regulations; (couvre-plancher)

- individually measured commodity

individually measured commodity[Repealed, SOR/2018-108, s. 385]

(2) Prepackaged products that are packaged from bulk on a retail premises, other than wallpaper or floor covering, are exempt from paragraph 4(1)(b) of the Act and from section 14 of these Regulations, if the net quantity of the product is clearly shown on the principal display panel of its label in terms of a Canadian unit.

(3) [Repealed, SOR/2018-108, s. 385]

(4) [Repealed, SOR/2018-108, s. 385]

- SOR/78-789, s. 1

- SOR/80-840, s. 1

- SOR/82-411, s. 2

- SOR/2018-108, s. 385

20 [Repealed, SOR/78-789, s. 2]

Manner of Declaring Net Quantity

21 Subject to sections 22, 23 and 36, the declaration of net quantity of a prepackaged product shall show the quantity of the product

(a) by volume, when the product is a liquid or gas or is viscous, or

(b) by weight, when the product is solid,

unless it is the established trade practice to show the net quantity of the product in some other manner, in which case the declaration shall be in accordance with the established trade practice.

- SOR/78-171, s. 1

22 The declaration of net quantity of a prepackaged product that is packed for dispensing in aerosol form shall show the net quantity of the product by weight.

- SOR/78-171, ss. 2, 3

- SOR/78-789, ss. 3, 4

- SOR/81-580, s. 1

- SOR/2018-108, s. 386

23 (1) The declaration of net quantity of non-perforated rolls, sheets or other units of wrapping paper, plastic foil, aluminum foil, waxed paper, wall paper, adhesive tape or other non-perforated bidimensional products shall show the net quantity of the product by

(a) the number of rolls, sheets or other units in the package, if there is more than one;

(b) the length and width of each roll, sheet or other unit; and

(c) the area measurement of the roll or the total area measurement of all sheets or other units if each roll, sheet or other unit is more than four inches (10.2 centimetres) in width and more than one square foot (9.29 square decimetres) in area.

(2) The declaration of net quantity of rolls, sheets or other units of bathroom tissue, facial tissue, paper towels, paper napkins and other bidimensional products that have one or more plys and are sold in separate or perforated individual units shall show the net quantity of the product by

(a) the number of rolls, sheets or other units in the package, if there is more than one;

(b) the length and width of each separate or perforated individual unit;

(c) the number of plys of each separate or perforated individual unit unless the product is one of a class of products that is made only in a single ply; and

(d) in the case of roll products, the number of perforated individual units in the roll.

(3) Where the package contains different bidimensional products, the net quantity of each such product shall be shown as required by this section.

Units of Measurement

24 The declaration of net quantity in Canadian units for a measurement of volume less than one gallon shall be shown in fluid ounces, except that 20 fluid ounces may be shown as being one pint, 40 fluid ounces as being one quart, 60 fluid ounces as being three pints, 80 fluid ounces as being two quarts or 1/2 gallon and 120 fluid ounces as being three quarts.

25 The declaration of net quantity in metric units shall be shown in the decimal system to three figures, except that where the net quantity is below 100 grams, millilitres, cubic centimetres, square centimetres or centimetres, it may be shown to two figures and, in either case, any final zero appearing to the right of the decimal point need not be shown.

26 Where a net quantity less than a whole number is shown in the declaration of net quantity of a prepackaged product in a metric unit, it shall be shown

(a) in the decimal system with the numeral zero preceding the decimal point; or

(b) in words.

27 Subject to section 27.1, where the declaration of net quantity of a prepackaged product is shown in metric units, the metric units shall be in

(a) millilitres, where the net volume of the product is less than 1 000 millilitres, except that 500 millilitres may be shown as being 0.5 litre;

(b) litres, where the net volume is 1 000 millilitres or more;

(c) grams, where the net weight is less than 1 000 grams, except that 500 grams may be shown as being 0.5 kilogram;

(d) kilograms, where the net weight is 1 000 grams or more;

(e) centimetres or millimetres, where the length is less than 100 centimetres;

(f) metres, where the length is 100 centimetres or more;

(g) square centimetres, where the area is less than 100 square centimetres;

(h) square decimetres, where the area is 100 square centimetres or more, but less than 100 square decimetres;

(i) square metres, where the area is one square metre or more;

(j) cubic centimetres, where the cubic measurement is less than 1 000 cubic centimetres;

(k) cubic decimetres, where the cubic measurement is one cubic decimetre or more but less than 1 000 cubic decimetres; and

(l) cubic metres, where the cubic measurement is one cubic metre or more.

- SOR/80-840, s. 2

27.1 Notwithstanding paragraph 27(c), where the net weight of

(a) a prepackaged product that is packaged from bulk on a retail premises, or

(b) a prepackaged catch weight product that is sold by a retailer

is less than 1 000 grams and the declaration of net quantity is shown in terms of metric units of weight, the metric units may be shown in terms of grams or a decimal fraction of a kilogram.

- SOR/80-840, s. 3

Prepackaged Products Consisting of Products Packaged Separately

28 (1) Where a prepackaged product is sold as one unit but consists of two or more products that are packaged separately and labelled with the information required to be shown on prepackaged products, the declaration of net quantity shall show

(a) the number of products in each class and the identity of each class in terms of common, generic or functional name;

(b) the total net quantity of products in each class in the unit or the individual net quantity of each identical product in the class in the unit; and

(c) if a class of product in the unit contains only one product, the net quantity of that product.

(2) Despite subsection (1), if a prepackaged product referred to in that subsection consists of less than seven identical products that are packaged separately and those products are labelled to show all of the information required by the Act and these Regulations and that information is clearly visible at the time of sale, no information is required to be shown on the prepackaged product being sold as one unit and the prepackaged product is exempt from sections 4 and 10 of the Act.

Advertisements

29 (1) Subject to subsections (2) and (3), where the declaration of net quantity of a prepackaged product is in terms of metric and Canadian units, an advertisement for such product may show its net quantity in terms of either a metric or a Canadian unit of measurement.

(2) During the year 1980, Canadian units of measurement shall not be used in any advertisement within retail premises for a wallpaper or any “floor covering” within the meaning of section 342 of the Weights and Measures Regulations unless the equivalent metric units of measurement are shown in a manner at least as prominent as the Canadian units.

(3) After December 31, 1980, Canadian units of measurement shall not be used in any advertisement for a wallpaper or any “floor covering” within the meaning of section 342 of the Weights and Measures Regulations.

- SOR/80-840, s. 4

Name and other Information

30 Where by any enactment of the Parliament of Canada or any regulation made pursuant thereto, a common, generic or functional name for a product is prescribed, that name shall be used as the common, generic or functional name of the prepackaged product for the purpose of subparagraph 10(b)(ii) of the Act.

31 (1) Where any reference, direct or indirect, is made on a label to a place of manufacture and the reference is made with respect to the place of manufacture of the label or container and not to the place of manufacture of the product, the reference shall be accompanied by an additional statement indicating that the place of manufacture refers only to the label or container.

(2) Where a prepackaged product that is wholly manufactured or produced in a country other than Canada has applied to it, whether in Canada or elsewhere, a label that shows the identity and principal place of business of the person in Canada for whom the prepackaged product was manufactured or produced for resale, the identity and principal place of business of that person shall be preceded by the words “imported by” (“importé par”) or “imported for” (“importé pour”), as the case may be, unless the geographic origin of the prepackaged product is stated on the label.

(3) Where a product that is wholly manufactured or produced in a country other than Canada is packaged in Canada at other than the retail level of trade and the resulting prepackaged product has applied to it a label that shows the identity and principal place of business of either the person in Canada for whom the product was manufactured or produced for resale in prepackaged form or for whom the prepackaged product was manufactured or produced for resale, the identity and principal place of business of that person shall be preceded by the words “imported by” (“importé par”) or “imported for” (“importé pour”), as the case may be, unless the geographic origin of the product is stated on the label.

(4) Subject to the requirements of any other applicable federal or provincial law, the statement of geographic origin referred to in subsections (2) and (3) shall be located immediately adjacent to the declaration of dealer identity and principal place of business and shall be shown in letters at least as large as those used in the declaration of the Canadian dealer’s principal place of business.

(5) Subsections (2) and (4) do not apply to a prepackaged product labelled in Canada prior to November 1, 1982.

(6) Subsections (3) and (4) do not apply to a prepackaged product packaged and labelled in Canada prior to November 1, 1982.

(7) Subsection (4) does not apply to a prepackaged product manufactured or produced and labelled in a country other than Canada prior to November 1, 1982.

- SOR/81-906, s. 1

32 [Repealed, SOR/2018-108, s. 388]

33 [Repealed, SOR/2018-108, s. 388]

34 [Repealed, SOR/2018-108, s. 388]

35 [Repealed, SOR/96-278, s. 3]

Standardization of Container Sizes

- SOR/96-278, s. 4(F)

36 (1) Subject to subsection (3), a prepackaged product consisting of facial tissue, that is manufactured before January 1, 1997, may only be sold in a container whose size corresponds to a net quantity of product

(a) of a numerical count of less than 50;

(b) of a numerical count of 50, 60, 100, 120, 150 or 200; or

(c) of a numerical count of more than 200, if the container is of a size that corresponds to a net quantity of product that is a multiple of 100 units.

(2) Subject to subsection (3), the net quantity of a prepackaged product referred to in subsection (1) shall be shown in terms of numerical count.

(3) Subsections (1) and (2) do not apply in respect of a test market product as defined in subsection 6(1), if the dealer who intends to conduct the test marketing of the product has, six weeks before conducting the test marketing, filed with the Minister a notice of intention, in a form established by the Minister.

- SOR/78-171, ss. 5 to 7

- SOR/78-789, s. 5

- SOR/79-683, s. 1

- SOR/81-580, s. 2

- SOR/81-621, s. 1

- SOR/83-33, s. 1

- SOR/84-161, s. 1

- SOR/85-441, s. 1

- SOR/96-278, s. 5

- SOR/2018-108, s. 389

Capacity of Receptacles

37 (1) In this section, receptacle means a receptacle that is designed for household, camping or recreational use and includes a water tank for household use.

(2) Subparagraph 10(b)(iii) of the Act applies to a product that is a receptacle and that is not a prepackaged product but is ordinarily sold to or purchased by a consumer in the manner described in subparagraph 18(1)(h)(i) or (ii) of the Act.

(3) Where a dealer sells, advertises or imports into Canada a receptacle, whether or not such receptacle is a prepackaged product, and the receptacle bears a label describing its size or capacity in terms of pints, quarts or gallons, the label and any advertisement that describes its size or capacity in terms of pints, quarts or gallons shall show the size or capacity in terms of Canadian pints, quarts or gallons.

(4) The size of type used to show the Canadian size or capacity shall be at least equal to that used to describe its size or capacity in terms of any other pints, quarts or gallons and the Canadian size or capacity shall be shown adjacent to any other description of its size or capacity.

Tolerances

38 (1) For the purposes of Schedule I, catch weight product means a prepackaged product that because of its nature cannot normally be portioned to a predetermined quantity and is, as a result, usually sold in varying quantities.

(2) The prescribed tolerance for the purposes of subsection 7(3) of the Act is that set out in Column II of an item of the appropriate Part of Schedule I for the declared net quantity set out in Column I of that item.

- SOR/89-571, s. 1

Examination

39 (1) The examination of any quantity of prepackaged products that are owned by a dealer, hereinafter referred to as a lot, each unit of which purports to contain the same net quantity of product, that an inspector undertakes to determine whether the lot meets the requirements of the Act and these Regulations respecting the declaration of net quantity, shall be made by selecting and examining a sample from the lot.

(2) Subject to subsection (3), where a lot contains the number of units set out in Column I of an item of Part I of Schedule II, an inspector shall select from the lot a number of units not less than the number set out in Column II of that item and the number of the units selected shall constitute the sample referred to in subsection (1).

(3) Where, for the purpose of determining the net quantity, other than for establishing the weight of the container, it is necessary to destroy a certain number of units in the lot, an inspector shall select, for destruction, not more than 10 per cent of the total number of units in the lot and not less than one unit and the number of units selected shall constitute the sample referred to in subsection (1).

(4) The lot from which a sample was taken and examined by an inspector does not meet the requirements of the Act and these Regulations respecting the declaration of net quantity where the inspector determines that

(a) the weighted average quantity of the units in the sample, as determined by the formula set out in Part II of Schedule II, is less than the declared net quantity;

(b) the number of units in the sample that contain less than the declared net quantity by more than the prescribed tolerance set out in Schedule I for that quantity is equal to or greater than the number set out in Column II of Part IV of Schedule II for the sample size set out in Column I thereof; or

(c) two or more units in the sample contain less than the declared net quantity by more than twice the prescribed tolerance set out in Schedule I for that quantity.

- SOR/89-571, s. 2

40 If a prepackaged product consisting of liquid is inspected, the net quantity of the prepackaged product shall be determined on the basis of the assumption that the liquid is at a temperature of 20°C (68°F).

40.1 [Repealed, SOR/89-525, s. 1]

41 to 46 [Repealed, SOR/93-287, s. 1]

SCHEDULE I(Section 38)

PART I

Tolerances for Net Quantities Declared in Metric Units of Mass for Catch Weight Products

| Column I | Column II | ||

|---|---|---|---|

| Item | Declared Net Quantity | Tolerance | grams |

| % | |||

| grams | |||

| 1 | more than 0 to not more than 60 | 10 | — |

| 2 | more than 60 to not more than 600 | — | 6 |

| 3 | more than 600 to not more than 1 000 | 1 | — |

| kilograms | |||

| 4 | more than 1 to not more than 1.5 | — | 10 |

| 5 | more than 1.5 to not more than 3 | 0.66 | — |

| 6 | more than 3 to not more than 4 | — | 20 |

| 7 | more than 4 to not more than 10 | 0.5 | — |

| 8 | more than 10 to not more than 15 | — | 50 |

| 9 | more than 15 to not more than 250 | 0.33 | — |

| 10 | more than 250 to not more than 500 | — | 750 |

| 11 | more than 500 | 0.15 | — |

PART II

Tolerances for Net Quantities Declared in Canadian Units of Mass or Weight for Catch Weight Products

| Column I | Column II | ||

|---|---|---|---|

| Item | Declared Net Quantity | Tolerance | ounces |

| % | |||

| ounces | |||

| 1 | more than 0 to not more than 2 | 10 | — |

| 2 | more than 2 to not more than 20 | — | 0.2 |

| pounds | |||

| 3 | more than 1.25 to not more than 2.2 | 1 | — |

| 4 | more than 2.2 to not more than 3.3 | — | 0.35 |

| 5 | more than 3.3 to not more than 6.6 | 0.66 | — |

| 6 | more than 6.6 to not more than 8.8 | — | 0.71 |

| 7 | more than 8.8 to not more than 22 | 0.5 | — |

| 8 | more than 22 to not more than 33 | — | 1.76 |

| 9 | more than 33 to not more than 550 | 0.33 | — |

| 10 | more than 550 to not more than 1100 | — | 26.4 |

| 11 | more than 1100 | 0.15 | — |

PART III

Tolerances for Net Quantities Declared in Metric Units of Mass or Volume for Prepackaged Products other than Catch Weight Products

| Column I | Column II | ||

|---|---|---|---|

| Item | Declared Net Quantity | Tolerance | grams or millilitres |

| % | |||

| grams or millilitres | |||

| 1 | more than 0 to not more than 50 | 9 | — |

| 2 | more than 50 to not more than 100 | — | 4.5 |

| 3 | more than 100 to not more than 200 | 4.5 | — |

| 4 | more than 200 to not more than 300 | — | 9 |

| 5 | more than 300 to not more than 500 | 3 | — |

| 6 | more than 500 to not more than 1 kilogram or litre | — | 15 |

| kilograms or litres | |||

| 7 | more than 1 to not more than 10 | 1.5 | — |

| 8 | more than 10 to not more than 15 | — | 150 |

| 9 | more than 15 | 1 | — |

PART IV

Tolerances for Net Quantities Declared in Canadian Units of Mass or Weight for Prepackaged Products other than Catch Weight Products

| Column I | Column II | ||

|---|---|---|---|

| Item | Declared Net Quantity | Tolerance | ounces |

| % | |||

| ounces | |||

| 1 | more than 0 to not more than 1.75 | 9 | — |

| 2 | more than 1.75 to not more than 3.5 | — | 0.16 |

| 3 | more than 3.5 to not more than 7 | 4.5 | — |

| 4 | more than 7 to not more than 10.6 | — | 0.32 |

| 5 | more than 10.6 to not more than 17.6 | 3 | — |

| pounds | |||

| 6 | more than 1.1 to not more than 2.2 | — | 0.53 |

| 7 | more than 2.2 to not more than 22 | 1.5 | — |

| 8 | more than 22 to not more than 33 | — | 5.28 |

| 9 | more than 33 | 1 | — |

PART V

Tolerances for Net Quantities Declared in Canadian Units of Volume for Prepackaged Products other than Catch Weight Products

| Column I | Column II | ||

|---|---|---|---|

| Item | Declared Net Quantity | Tolerance | fluid ounces |

| % | |||

| fluid ounces | |||

| 1 | more than 0 to not more than 1.75 | 9 | — |

| 2 | more than 1.75 to not more than 3.5 | — | 0.16 |

| 3 | more than 3.5 to not more than 7 | 4.5 | — |

| 4 | more than 7 to not more than 10.6 | — | 0.32 |

| 5 | more than 10.6 to not more than 17.6 | 3 | — |

| 6 | more than 17.6 to not more than 35.2 | — | 0.53 |

| 7 | more than 35.2 to not more than 2.2 gallons | 1.5 | — |

| gallons | |||

| 8 | more than 2.2 to not more than 3.3 | — | 5.28 |

| 9 | more than 3.3 | 1 | — |

PART VI

Tolerances for Net Quantities of Solid Prepackaged Products Declared in Metric Units of Volume

| Column I | Column II | |

|---|---|---|

| Item | Declared Net Quantity | Tolerance |

| cubic metres | ||

| 1 | less than 1 | 3% of declared net quantity |

| 2 | from 1 to 2 | 0.03 cubic metres |

| 3 | more than 2 | 1.5% of declared net quantity |

PART VII

Tolerances for Net Quantities of Solid Prepackaged Products Declared in Canadian Units of Volume

| Column I | Column II | |

|---|---|---|

| Item | Declared Net Quantity | Tolerance |

| cubic yards | ||

| 1 | less than 1 | 3% of declared net quantity |

| 2 | from 1 to 2 | 0.03 cubic yards |

| 3 | more than 2 | 1.5% of declared net quantity |

PART VIII

Tolerances for Net Quantities of Prepackaged Products Declared in Metric Units of Length

| Column I | Column II | |

|---|---|---|

| Item | Declared Net Quantity | Tolerance |

| metres | ||

| 1 | less than 3 | 2% of declared net quantity |

| 2 | from 3 to 6 | 60 millimetres |

| 3 | more than 6 | 1% of declared net quantity |

PART IX

Tolerances for Net Quantities of Prepackaged Products Declared in Canadian Units of Length

| Column I | Column II | |

|---|---|---|

| Item | Declared Net Quantity | Tolerance |

| feet | ||

| 1 | less than 10 | 2% of declared net quantity |

| 2 | from 10 to 20 | 2.4 inches |

| 3 | more than 20 | 1% of declared net quantity |

PART X

Tolerances for Net Quantities of Prepackaged Products Declared in Metric Units of Area

| Column I | Column II | |

|---|---|---|

| Item | Declared Net Quantity | Tolerance |

| square metres | ||

| 1 | less than 10 | 2% of declared net quantity |

| 2 | from 10 to 20 | 20 square decimetres |

| 3 | more than 20 | 1% of declared net quantity |

PART XI

Tolerances for Net Quantities of Prepackaged Products Declared in Canadian Units of Area

| Column I | Column II | |

|---|---|---|

| Item | Declared Net Quantity | Tolerance |

| square feet | ||

| 1 | less than 100 | 2% of declared net quantity |

| 2 | from 100 to 200 | 2 square feet |

| 3 | more than 200 | 1% of declared net quantity |

PART XII

Tolerances for Net Quantities of Prepackaged Products Declared by Number

| Column I | Column II | |

|---|---|---|

| Item | Declared Net Quantity | Tolerance |

| number of articles | ||

| 1 | less than 50 | 0 article |

| 2 | from 50 to 100 | 1 article |

| 3 | more than 100 with an individual weight of 14 grams or less, or 1/2 ounce or less | 0.75% of the declared net quantity, rounded up to the next whole number |

| 4 | more than 100 with an individual weight of more than 14 grams, or more than 1/2 ounce | 0.5% of the declared net quantity, rounded up to the next whole number |

- SOR/89-571, s. 3

SCHEDULE II(Section 39)

PART ISamples

| Column I | Column II | |

|---|---|---|

| Item | Number of Units in the Lot | Minimum Number of Units in the Sample |

| 1 | from 2 to 10 | All the units in the lot |

| 2 | from 11 to 128 | 25% of the units in the lot, rounded up to the next whole number, but not less than 10 |

| 3 | from 129 to 4 000 | 32 |

| 4 | from 4 001 to 8 000 | 64 |

| 5 | from 8 001 to 12 000 | 96 |

| 6 | more than 12 000 | 125 |

PART IIFormula for Determining the Weighted Average Quantity of the Units in a Sample

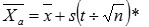

For the purposes of paragraph 39(4)(a), the formula for adjusting the sample mean to determine the weighted average quantity of the units in the sample is as follows

where

- a

- is the weighted average quantity of the units in the sample

- is the sample mean calculated as follows:

= ∑x ÷ n

- ∑x

- is the sum of the net quantities of all units in the sample

- t

- is the value determined in accordance with Part III for the selected sample size

- n

- is the number of units in the sample

- s

- is the standard deviation of the sample, calculated as follows

- ∑(x-)2

- is the sum of the squared differences between the sample mean and the net quantity of each unit in the sample.

*The value of (t ÷ √n) may, instead of being calculated in accordance with this Part, be determined using the applicable value set out in Column III of the table to Part III

PART IIITable for Values of t and (t ÷ √n)

| Column I | Column II | Column III | |

|---|---|---|---|

| Sample Size | tFootnote for * | (t ÷ √n)Footnote for * | |

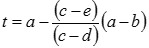

| 2 | 63.657 | 45.01 | Linear Interpolation of ValuesWhere a sample size is selected that is not listed in Column I of this table and lies between 32 and 125, the value of t will be determined by linear interpolation as follows:  where

|

| 3 | 9.925 | 5.73 | |

| 4 | 5.841 | 2.92 | |

| 5 | 4.604 | 2.06 | |

| 6 | 4.032 | 1.65 | |

| 7 | 3.707 | 1.40 | |

| 8 | 3.499 | 1.24 | |

| 9 | 3.355 | 1.12 | |

| 10 | 3.250 | 1.03 | |

| 11 | 3.169 | 0.955 | |

| 12 | 3.106 | 0.897 | |

| 13 | 3.055 | 0.847 | |

| 14 | 3.012 | 0.805 | |

| 15 | 2.977 | 0.769 | |

| 16 | 2.947 | 0.737 | |

| 17 | 2.921 | 0.708 | |

| 18 | 2.898 | 0.683 | |

| 19 | 2.878 | 0.660 | |

| 20 | 2.861 | 0.640 | |

| 21 | 2.845 | 0.621 | |

| 22 | 2.831 | 0.604 | |

| 23 | 2.819 | 0.588 | |

| 24 | 2.807 | 0.573 | |

| 25 | 2.797 | 0.559 | |

| 26 | 2.787 | 0.547 | |

| 27 | 2.779 | 0.535 | |

| 28 | 2.771 | 0.524 | |

| 29 | 2.763 | 0.513 | |

| 30 | 2.756 | 0.503 | |

| 31 | 2.750 | 0.494 | |

| 32 | 2.746 | 0.485 | |

| 64 | 2.657 | 0.332 | |

| 96 | 2.634 | 0.269 | |

| 125 | 2.615 | 0.234 |

Return to footnote *Where all units in a lot are selected to constitute a sample, zero shall be used as the value of t and (t ÷ √n).

PART IVMinimum Number of Units for the Purposes of Paragraph 39(4)(B)

| Column I | Column II | |

|---|---|---|

| Item | Sample Size | Minimum Number of UnitsFootnote for * |

| 1 | from 2 to 8 | 1 |

| 2 | from 9 to 20 | 2 |

| 3 | from 21 to 32 | 3 |

| 4 | from 33 to 50 | 4 |

| 5 | from 51 to 65 | 5 |

| 6 | from 66 to 80 | 6 |

| 7 | from 81 to 102 | 7 |

| 8 | from 103 to 125 | 8 |

Return to footnote *Minimum number of units in the sample that results in the lot not meeting the requirements of the Act and these Regulations respecting the declaration of net quantity.

- SOR/89-571, s. 4

SCHEDULE III

- Date modified: