Reduction of Carbon Dioxide Emissions from Coal-fired Generation of Electricity Regulations (SOR/2012-167)

Full Document:

- HTMLFull Document: Reduction of Carbon Dioxide Emissions from Coal-fired Generation of Electricity Regulations (Accessibility Buttons available) |

- XMLFull Document: Reduction of Carbon Dioxide Emissions from Coal-fired Generation of Electricity Regulations [228 KB] |

- PDFFull Document: Reduction of Carbon Dioxide Emissions from Coal-fired Generation of Electricity Regulations [551 KB]

Regulations are current to 2024-06-19 and last amended on 2018-11-30. Previous Versions

PART 1Regulated Units and Emission Limit (continued)

Carbon Capture and Storage (continued)

Temporary Exemption — System to be Constructed (continued)

Marginal note:Updated information

12 If any event occurs or any circumstance arises that may prejudice the ability of the responsible person to achieve an objective referred to in paragraph 11(1)(e), the responsible person must send to the Minister, without delay, a notice that indicates the unit’s registration number and contains the following information:

(a) a description of the event or circumstance and the nature of the prejudice;

(b) an explanation of how the prejudice is to be overcome in order to ensure that the objective will be achieved; and

(c) in relation to that explanation, an update to any information previously provided to the Minister under paragraphs 11(1)(c) to (e), together with any necessary supporting documents.

Marginal note:Revocation — non-satisfaction or misleading information

13 (1) The Minister must revoke a temporary exemption granted under subsection 9(3) if

(a) the responsible person does not satisfy a requirement set out in section 10; or

(b) any information indicated or contained in the application for the temporary exemption, in an implementation report referred to in section 11 or in a notice referred to in section 12 is false or misleading.

Marginal note:Revocation — implementation report or reasonable grounds

(2) The Minister may revoke the temporary exemption if

(a) the responsible person has not provided an implementation report in accordance with section 11;

(b) there are reasonable grounds for the Minister to believe that the carbon capture and storage system will not operate so as to capture, transport and store CO2 emissions as described in paragraph 10(e) by the date referred to in that paragraph; or

(c) there are reasonable grounds for the Minister to believe that the responsible person will not emit CO2 from the combustion of fossil fuels in the unit in accordance with subsection 3(1) by January 1, 2025.

Marginal note:Reasons and representations

(3) The Minister must not revoke the temporary exemption under subsection (1) or (2) unless the Minister has provided the responsible person with

(a) written reasons for the proposed revocation; and

(b) an opportunity to be heard, by written representation, in respect of the proposed revocation.

Twenty-four Month Exemption — Existing Unit with System

Marginal note:Exemption

14 (1) A responsible person for an old unit may, on application made to the Minister, be exempted from the application of subsection 3(1) in respect of the old unit for a period of 24 consecutive months that begins on January 1 of the calendar year that follows the calendar year in which the application is made if the following conditions are satisfied:

(a) an existing unit and the old unit have a common owner who has a ownership interest of 50% or more in each of those two units;

(b) the production capacity of the existing unit, during the calendar year preceding the calendar year in which the application is made, was equal to or greater than the production capacity of the old unit during that preceding calendar year;

(c) the existing unit and the old unit are located in the same province;

(d) the quantity of CO2 emissions from the combustion of fossil fuels in the existing unit is determined in accordance with a system or method referred to in subsection 20(1);

(e) the quantity of CO2 emissions from the combustion of fossil fuels in the existing unit that are captured, transported and stored is determined using a direct measure of the flow of, and the concentration of CO2 in, the emissions from that combustion of fuel;

(f) the emissions referred to in paragraph (e) are captured in accordance with the laws of Canada or a province that regulate that capture and are transported and stored in accordance with the laws of Canada or a province, or of the United States or one of its states, that regulate that transportation or storage, as the case may be;

(g) the emissions referred to in paragraph (e) are captured, transported and stored for a period of seven consecutive calendar years;

(h) the emissions referred to in paragraph (e) comprise at least 30% of the quantity of CO2 emissions produced from the combustion of fossil fuels in the existing unit for each calendar year during that seven-year period; and

(i) the existing unit does not reach the end of its useful life during that seven-year period.

Marginal note:Application

(2) A responsible person for an old unit must apply for the exemption before September 1 of the calendar year preceding the calendar year for which the exemption is sought.

Marginal note:Contents

(3) The application must include the registration number of the old unit and of the existing unit and information, with supporting documentation, to demonstrate that

(a) the conditions of paragraphs (1)(a) to (f), (h) and (i) are satisfied; and

(b) at least 30 consecutive months of the period referred to in paragraph (1)(g) have occurred before the day on which the application is made.

Marginal note:Granting of exemption

(4) The Minister must, within 30 days after receiving the application, grant the exemption if

(a) no exemption referred to in subsection (1) has been previously granted in respect of the old unit;

(b) no exemption referred to in subsection (1) that involved the existing unit has been previously granted;

(c) the existing unit referred to in subsection (1) is not a substituted unit referred to in subsection 5(5); and

(d) the Minister is satisfied that the requirements set out in subsection (3) are satisfied.

Marginal note:Obligation to capture 30% of CO2 emissions

(5) A responsible person who has been exempted under subsection (4) in respect of an existing unit must ensure that the conditions of paragraphs (1)(a) to (f), (h) and (i) are satisfied for the portion of the period referred to in paragraph (1)(g) that remains after the occurrence of the period of consecutive months described in paragraph (3)(b).

- SOR/2018-263, s. 7

PART 2Reporting, Sending, Recording and Retention of Information

Marginal note:Annual report

15 For each calendar year, a responsible person for each of the following units must, on or before June 1 that follows that calendar year, send an annual report to the Minister that contains the information set out in Schedule 4:

(a) a new unit;

(b) an old unit;

(c) a substituted unit referred to in subsection 5(5);

(d) an existing unit referred to in subsection 14(1), if that calendar year is a calendar year included in the remaining portion of the seven consecutive calendar years referred to in subsection 14(5).

Marginal note:Electronic report, notice and application

16 (1) A report or notice that is required, or an application that is made, under these Regulations must be sent electronically in the form and format specified by the Minister and must bear the electronic signature of an authorized official of the responsible person.

Marginal note:Paper report or notice

(2) If the Minister has not specified an electronic form and format or if it is impractical to send the report, notice or application electronically in accordance with subsection (1) because of circumstances beyond the person’s control, the report, notice or application must be sent on paper, signed by an authorized official of the responsible person, and in the form and format specified by the Minister. However, if no form and format have been so specified, it may be in any form and format.

Marginal note:Record-making

17 (1) A responsible person for a unit must make a record

(a) of any notice referred to in subsection 4(3), 5(6) or 6(6) or section 12 that was sent to the Minister and the information that was contained in it, as well as any supporting documents;

(b) of any application referred to in subsection 5(3), 6(3), 7(3), 8(2), 9(2) or 14(3) and the information referred to in the subsection, as well as any supporting documents;

(c) of every direct measure of the flow of, and the concentration of CO2 in, emissions referred to in paragraph 14(1)(e), subsection 20(2) and the descriptions of Enon-ccs in subsection 21(1) and of Eccs in section 22;

(d) of every measurement and calculation used to determine a value of an element of a formula set out in any of sections 19 and 21 to 24;

(e) that demonstrates that any meter referred to in section 19 complies with the requirements of the Electricity and Gas Inspection Act and the Electricity and Gas Inspection Regulations, including a certificate referred to in section 14 of that Act;

(f) for each calendar year during which a responsible person used a continuous emission monitoring system referred to in paragraph 20(1)(a), of any document, record or information referred to in section 8 of the Reference Method;

(g) that demonstrates that the installation, maintenance and calibration of measuring devices referred to in subsection 25(1) was in accordance with that subsection and subsection 25(3) and of every calibration referred to in subsection 25(2); and

(h) of the results of the analysis of every sample collected in accordance with section 27.

Marginal note:When records made

(2) Records referred to in paragraphs (1)(c) to (h) must be made as soon as feasible but not later than 30 days after the information to be recorded becomes available.

Marginal note:Retention of records and reports

18 (1) A responsible person who is required under these Regulations to make a record or send a report or notice must keep the record or a copy of the report or notice, as well as any supporting documents that relate to the information contained in that record or copy, for at least seven years after they make the record or send the report or notice. The record or copy must be kept at the person’s principal place of business in Canada or at any other place in Canada where it can be inspected. If the record or copy is kept at any of those other places, the person must provide the Minister with the civic address of that other place.

Marginal note:Change of address

(2) If the civic address referred to in subsection (1) changes, the responsible person must notify the minister in writing within 30 days after the change.

PART 3Quantification Rules

Production of Electricity

Marginal note:Electricity

19 (1) The quantity of electricity referred to in paragraph 3(2)(a) is to be determined in accordance with the following formula:

Ggross – Gaux

where

- Ggross

- is the gross quantity of electricity that is produced by the unit during the calendar year, expressed in GWh and measured at the electrical terminals of the generators of the unit using meters that comply with the requirements of the Electricity and Gas Inspection Act and the Electricity and Gas Inspection Regulations; and

- Gaux

- is the quantity of electricity that is produced by the unit and used by the power plant in which the unit is located during the calendar year to operate infrastructure and equipment that is attributed to the unit for electricity generation and for separation, but not for pressurization, of CO2, expressed in GWh, determined in accordance with an appropriate method of attribution, based on data collected using meters that comply with the requirements of the Electricity and Gas Inspection Act and the Electricity and Gas Inspection Regulations.

Marginal note:Same method of attribution in subsequent years

(2) Once a method of attribution is used to make the determination referred to in the description of Gaux for a calendar year, that method of attribution must be used to make that determination for every subsequent calendar year, unless

(a) during a subsequent calendar year, a unit located at the power plant ceases to produce electricity or a new unit is added to those located at the power plant; or

(b) during a subsequent calendar year, the operation of any unit located at the power plant is integrated with a carbon capture and storage system.

Marginal note:Change of method of attribution

(3) If paragraph (2)(a) or (b) applies in a subsequent calendar year, the responsible person must, when making the determination referred to in the description of Gaux in subsection (1) for that subsequent calendar year, use a method of attribution that is appropriate to the circumstances described in that paragraph. Subsection (2) applies in respect of that appropriate method of attribution and that subsequent calendar year as if they were, respectively, the method of attribution and the calendar year referred to in that subsection.

- SOR/2018-263, s. 8

CO2 Emissions

Means of Quantification

Marginal note:CEMS or fuel-based methods

20 (1) For the purposes of sections 3 and 15, the quantity of CO2 emissions from the combustion of fossil fuels in a unit for a calendar year is to be determined

(a) by using a continuous emission monitoring system (CEMS) in accordance with section 21; or

(b) by using a fuel-based method, based on the quantity of carbon in the fossil fuel fed for combustion, in accordance with section 22 and section 23 or 24.

Marginal note:Emissions from coal gasification systems

(2) If a coal gasification system referred to in subsection 3(4) is used to produce fuel for a unit, the quantity of emissions from the unit referred to in subsection (1) must be determined in accordance with paragraph (1)(a). To the extent that the emissions from the coal gasification system are not captured, transported and stored as described in subsection 3(5), that quantity must be determined for the purpose of subsection 3(1) by using a direct measure of the flow of, and the concentration of CO2 in, those emissions.

Continuous Emissions Monitoring System

Marginal note:Quantification

21 (1) If paragraph 20(1)(a) applies, the quantity of CO2 emissions referred to in subsection 20(1) is to be determined in accordance with the following formula:

Eu – Ebio + Enon-ccs

where

- Eu

- is the quantity of CO2 emissions, expressed in tonnes, from the unit, “u”, during the calendar year from the combustion of fuel, as measured by the CEMS in accordance with sections 7.1 to 7.7 of the Reference Method;

- Ebio

- is the quantity of CO2 emissions, expressed in tonnes, from the combustion of biomass in the unit during the calendar year, determined

(a) by using a fuel-based method

(i) in accordance with paragraph 24(1)(a) or (b), if the unit combusts solid biomass at an average daily rate of less than 3t/day during the given calendar year, and

(ii) in accordance with the applicable formula set out in one of paragraphs 23(1)(a) to (c) for the type of biomass combusted, in any other case, or

(b) by using the method, based on data from the CEMS, described in subsection (2); and

- Enon-ccs

- is the quantity of CO2 emissions, expressed in tonnes, from the combustion of fuel in the unit, including those emissions referred to in subsection 3(4), during the calendar year — other than the quantity of those emissions as measured by the CEMS and set out in the description of Eu — that is determined using a direct measure of the flow of, and the concentration of CO2 in, the emissions from that combustion of fuel but that is not ultimately captured, transported and stored as described in subsection 3(5).

Marginal note:Ebio based on CEMS data

(2) For the purpose of determining the value of Ebio, the method, based on data from the CEMS, consists of making the following sequence of determinations:

(a) the volume of CO2 emitted from combustion of fuel in the unit for each hour of production of electricity during the calendar year determined in accordance with the following formula:

0.01 × %CO2w,h × Qw,h × th

where

- %CO2w,h

- is the average concentration of CO2 in relation to all gases in the stack emitted from the combustion of fuel in the unit during a given hour, “h”, during which the unit produced electricity in the calendar year — or, if applicable, a calculation made in accordance with section 7.4 of the Reference Method of that average concentration of CO2 based on a measurement of the concentration of oxygen (O2) in those gases in the stack — expressed as a percentage on a wet basis,

- Qw,h

- is the average volumetric flow during that hour, measured on a wet basis by the stack gas volumetric flow monitor, expressed in standard m3, and

- th

- is the period during which the unit produced electricity, expressed in hours;

(b) the volume of CO2 emitted from combustion of fossil fuel in the unit during the calendar year, expressed in standard m3 and referred to in this subsection as Vff, determined in accordance with the following formula:

where

- Qi

- is the quantity of fossil fuel type “i” combusted in the unit during the calendar year, determined

(a) for a solid fuel, in the same manner as the one used in the determination of Mf in the formula set out in paragraph 23(1)(a) and expressed in tonnes,

(b) for a liquid fuel, in the same manner as the one used in the determination of Vf in the formula set out in paragraph 23(1)(b) and expressed in kL, and

(c) for a gaseous fuel, in the same manner as the one used in the determination of Vf in the formula set out in paragraph 23(1)(c) and expressed in standard m3,

- i

- is the ith fossil fuel type combusted in the unit during the calendar year, with “i” going from the number 1 to n, where n is the number of fossil fuels so combusted,

- Fc,i

- is the fuel-specific carbon-based F-factor for each fossil fuel type “i” — being, as the case may be, the default value as set out in column 3 of the table to subsection (3) for that fuel type set out in column 2 or determined for that fuel type in accordance with Appendix A of the Reference Method — expressed in standard m3 of CO2/GJ,

- HHVd,i

- — expressed in GJ/tonne, for a solid fuel, in GJ/kL, for a liquid fuel, and in GJ/standard m3, for a gaseous fuel — is, for each fossil fuel type “i”,

(a) the default higher heating value set out in column 2 of Schedule 5 for that fuel type set out in column 1, and

(b) in the absence of a default higher heating value for that fuel type referred to in paragraph (a), a default higher heating value for that fuel type established by a body that is internationally recognized as being competent to establish default higher heating values for fuels;

(c) the volume of CO2 emitted from the combustion of biomass in the unit during the calendar year, expressed in standard m3 and referred to in this subsection as Vbio, determined in accordance with the following formula:

VT – Vff

where

- VT

- is the sum of the volumes of CO2 emitted from combustion of fuel in the unit during each hour of production of electricity during the calendar year, as determined under paragraph (a), and

- Vff

- is Vff determined in accordance with the formula set out in paragraph (b); and

(d) the quantity of the CO2 emissions from the combustion of biomass in the unit during the calendar year, namely Ebio determined in accordance with the formula set out in subsection (1), based on the following two determinations:

(i) the fraction of the volume of CO2 emissions from all fuel combusted in the unit attributable to the combustion of biomass in the unit during the calendar year, referred to in this section as Biofr, determined in accordance with the following formula:

where

- Vbio

- is the volume of CO2 emitted from the combustion of biomass in the unit during the calendar year determined in accordance with the formula set out in paragraph (c),

- VT

- is the value of VT determined in accordance with the formula set out in paragraph (c), and

(ii) the quantity of CO2 emissions described by Ebio determined in accordance with the following formula:

(Biofr× Eu) – Es

where

- Biofr

- is the fraction of the volume of CO2 emissions from all fuel combusted in the unit attributable to the combustion of biomass in the unit during the calendar year determined in accordance with the formula set out in subparagraph (i),

- Eu

- is the value of Eu determined in the formula set out in subsection (1), and

- Es

- is the quantity of CO2 emissions, expressed in tonnes, that is released from the use of sorbent to control the emission of sulphur dioxide from the unit during the calendar year, determined in accordance with the following formula:

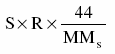

where

- S

- is the quantity of calcium carbonate (CaCO3) or other sorbent material so used, expressed in tonnes,

- R

- is the stoichiometric ratio, on a mole fraction basis, of CO2 released on usage of one mole of sorbent material, where R=1 if the sorbent material is CaCO3, and

- MMs

- is the molecular mass of the sorbent material, where MMs = 100 if the sorbent material is CaCO3.

Marginal note:Default F-factor

(3) The default value for the fuel-specific carbon-based F-factor for certain types of fossil fuel is set out in column 3 of the following table:

TABLE

Column 1 Column 2 Column 3 Item Fossil fuel Type F-factor (standard m3/GJ) 1 Coal Anthracite 54.2 Bituminous 49.2 Sub-bituminous 49.2 Lignite 53.0 2 Oil Crude, residual or distillate 39.3 3 Gas Natural 28.4 Propane 32.5 Marginal note:Common stack — disaggregation

(4) Despite subsection (1), if there is one or more other units at a power plant where a unit is located and a CEMS measures emissions from that unit and from one or more of those other units at a common stack rather than at the exhaust duct of that unit and of each of those other units that brings those emissions to the common stack, then the quantity of emissions attributable to that unit for the purpose of subsection (1) is determined based on the ratio of the heat input of that unit to the total of the heat input of that unit and of all of those other units sharing the common stack in accordance with the following formula:

where

- Quj

- is the quantity of fuel type “j” combusted in that unit “u” during the calendar year, determined

(a) for a solid fuel, in the same manner as the one used in the determination of Mf in the formula set out in paragraph 23(1)(a) and expressed in tonnes,

(b) for a liquid fuel, in the same manner as the one used in the determination of Vf in the formula set out in paragraph 23(1)(b) and expressed in kL, and

(c) for a gaseous fuel, in the same manner as the one used in the determination of Vf in the formula set out in paragraph 23(1)(c) and expressed in standard m3;

- HHVuj

- is the higher heating value, determined in accordance with section 24 and expressed in the applicable unit of measure referred to in that section of fuel type “j” combusted during the calendar year in that unit “u”;

- i

- is the ith unit located at the power plant with “i” going from the number 1 to n, where n is the number of units that share a common stack;

- j

- is the jth fuel type, including types of biomass, combusted during the calendar year in a unit located at the power plant with “j” going from the number 1 to m, where m is the number of those fuel types;

- Qij

- is the quantity of fuel type “j” combusted in each unit “i” during the calendar year, determined for a solid fuel, a liquid fuel and a gaseous fuel, respectively, in the manner set out in the description of Quj;

- HHVij

- is the higher heating value, determined in accordance with section 24 and expressed in the applicable unit of measure referred to in that section, of fuel type “j” combusted during the calendar year in unit “i”; and

- E

- is the quantity of CO2 emissions, expressed in tonnes, from the combustion of fuels in all the units during the calendar year, measured by a CEMS at the common stack in accordance with subsection 21(1).

- Date modified: